For most businesses, 2022 was the exchange of one hurdle for another. The pandemic finally eased away, but the economy softened. In additive manufacturing, these hurdles were an opportunity for some. There were 3D printer makers and resellers reporting record sales in 2022, driven in part by customers looking to reshore manufacturing and save money by bringing prototype production in-house.

“One thing I’d never seen before is organic interest from customers coming to us saying that they need to understand and do more in additive,” says Douglas Krone, CEO of Dynamism, a global 3D printer and material reseller. “This is a dramatic departure from the past 10 years we spent telling customers that they need to understand additive.”

However, the negative overall economic environment and sinking stock prices contributed to layoffs at 3D printing firms. There’s no denying the effect on the printer market from customers delaying their 2022 purchases because of economic uncertainty.

“The dream of solving supply chain issues and the theoretical advantages of AM are now a consideration at most companies,” says Sonja Rasch, sales director of additive manufacturing at Materialise, “but the practical implementation remains difficult, and many companies give up.”

But while the shadow of the pandemic and the weak economy may linger into 2023, there is optimism built on some of the top technology advancements of 2022.

For a deeper look at what to expect in 2023, we turned to our own All3DP Editorial Advisory Board of industry leaders for insight and context.

From a greater focus on print monitoring systems, pellet materials, and sustainability to more AI integration, our experts detail what they see coming to additive manufacturing in 2023.

Are You Optimistic About Growth?

On a scale from 1 to 10, our editorial advisory board rated their optimism about the 2023 additive manufacturing industry as, on average, 6.5. Most are cautiously optimistic hanging growth on having the right product mix and choosing the right projects to keep adoption moving forward. Others expect a stronger lift-off in two to three years when the current barriers to adoption — repeatability, reliability, education – gradually fade.

Even those with a pessimistic view for 2023 see a long-term bright future once hype becomes fact and consolidation creates the number of companies that the market can sustain.

Market Segments that Will Grow Most in 2023:

- Automotive

- Medical/Dental

- Aerospace

- End-use Consumer Products

- Construction

- Small Manufacturing

“Aerospace, medical, and automotive; I’d be surprised if any of those three verticals ever saw any kind of growth spike,” says Kristin Mulherin, founder of AM Cubed consultancy and president of Women in 3D Printing. “That’s just the nature of those three industries, they’re very steady but slow to adopt, they’re regulated, and the sales cycle is incredibly long, whereas in consumer goods, robotics, and industrial applications, you don’t have those hurdles so we may see new growth.”

One especially bright spot in AM is its application in some of the top “recession-proof” industries, such as oil & gas, defense, and transportation, the board noted.

“There’s been growing adoption of AM in these sectors, particularly for maintenance and repair of critical components, and it will continue to surge,” says Jos Burger, former long-time CEO of Ultimaker and now on the board of 3YourMind and other technology start-ups.

“The industries that will see the most growth in 2023 are where competition is the highest: defense, automotive, dental, and aerospace,” adds Diogo Quental, global VP of strategy, partnerships, and international business development at printer OEM Raise3D. “AM will become standard for these industries as a relevant complement to traditional manufacturing. Once that happens, small manufacturing will follow.”

The defense industry is another market poised for growth, our board agrees. From 3D printed drones to battlefield spare part production and even concrete 3D printing, military applications, which have long been studied, may begin to be implemented. “We can expect a structural change in defense spending,” says Quental, “with the installation of distributed manufacturing capacity to prepare for war scenarios. Defense can become a trigger for AM general adoption.”

What Was the Biggest Breakthrough of 2022?

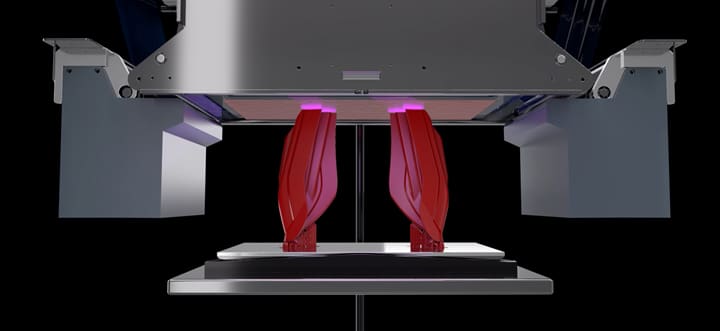

The theme of 2022, in a word, was speed. Across technologies and printers, boosting speed was a major breakthrough in 2022. Looking at just a few examples, Modix large-scale 3D printers upgraded its motor to boost speeds across its entire product line; miniFactory’s new Ultra 2 is two times faster than the company’s flagship Ultra; Photocentric re-engineered its desktop resin printer, the Liquid Crystal Magna v.2, to double its speed; Digital Metal’s new metal binder jet machine doubles the maximum speed of its older binder jet technology; 3D Systems new two-laser SLA doubles the speed of the company’s other SLA printers; Formlabs’ upgraded SLS printer, the Fuse 1+ 30W, prints twice as fast as its previous version and the company’s resin 3D printer, the Form 3+, is now 40% faster; and Raise3D launched an upgrade kit, called Hyper FFF, that includes new hardware, software, and filament to push the print speed on the FDM Pro3 Series to 350 mm/s.

After speed, our experts say materials advanced in 2022, specifically new extrudible thermoplastics with advanced engineering properties and a noticeable increase in pellet materials, which we’ll see more of in 2023.

“The trend towards granule or pellet-based additive manufacturing will continue to grow to replace expensive filament-based solutions,” says Brian Alexander, global AM product and business development manager at Solvay Specialty Polymers. “Powder-based solutions will still continue to be relevant but not grow to the same extent as the pellet-based technologies.”

Although there were new technologies launched in 2022, none of them have shifted the market in a significant way yet, our experts agree.

“I think the biggest innovation has still yet to come in terms of hardware precision, control, and repeatability with further monitoring systems to control both temperature and movements,” says Alexander.

New Application Opportunities

Innovations outside of additive manufacturing will continue to create new application opportunities. For example, in electric motors.

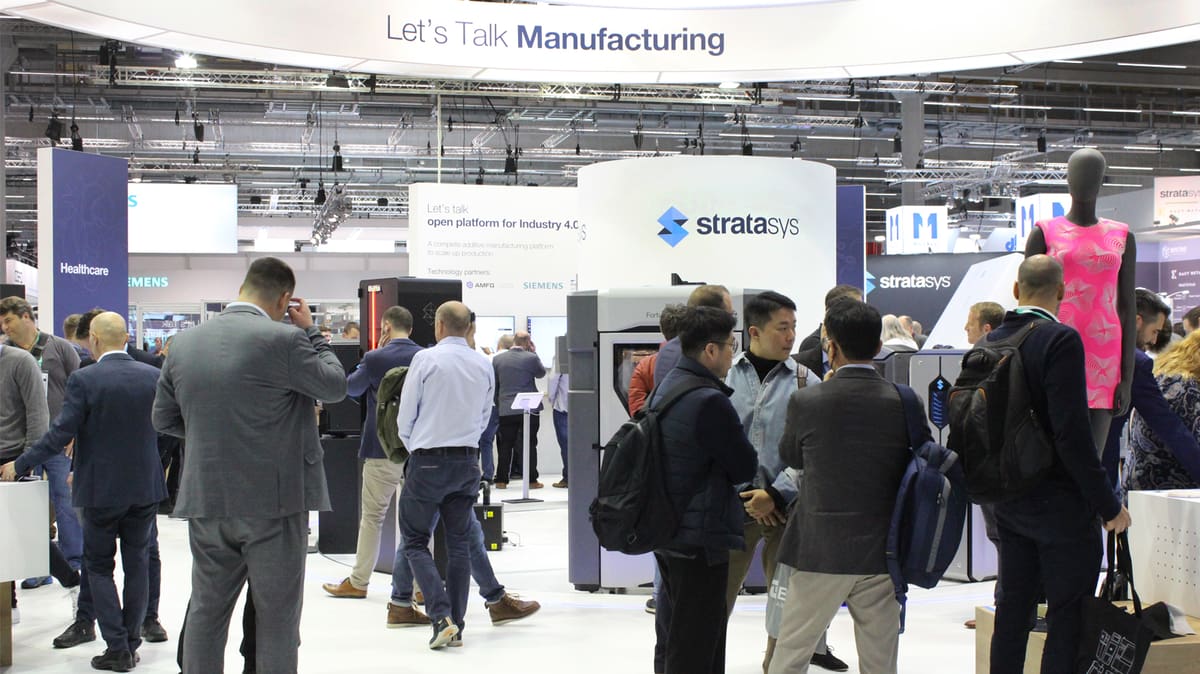

“The application of 3D printing in the electric vehicle market, in both engines and car bodies, is creating a global change across the industry that will enable significant growth and opportunity for AM,” says Patrick Carey, senior vice president of commercial systems at Stratasys. There’s also an opportunity for AM to play a major role in the growth of hydrogen engines for aircraft and space vehicles.

Overall democratization of additive manufacturing took a step forward in 2022, according to Tuan TranPham, chief revenue officer at Azul 3D. “We saw even more affordable laser powder bed fusion and selective laser sintering machines, like the Fuse 1+ 30W, and also cheap desktop-size metal binder jetting, like the M60 from start-up Sinterjet, and smaller and more affordable directed energy deposition.”

What Will Be the Most Significant AM Trends in 2023?

Last year, the All3DP Editorial Advisory Board said 2022 would usher in new advances in software, more focus on sustainability among large corporations, engineering-grade materials across technologies, and metal FDM. Predictions that were right on the money. For 2023, they say we’ll see continued interest in sustainability, rapid growth in the on-demand additive manufacturing sector, more applications of AI in hardware and software, and the adoption of AM as a redundant manufacturing and supply chain solution.

Undercurrent of Sustainability

Although approaches differ globally, sustainability continues to be a growing trend in additive manufacturing, more so in the EU than in North America, board members agreed.

“Companies are under more pressure to add sustainable solutions,” says Alexander. “Some larger OEM will not even look at a polymer for a new project unless they can justify some sustainable aspect of it, such as bio-sourced raw materials or a plan for recovery and recycling.”

The stance that AM enables sustainability in other industries is still strong and will remain a key message in 2023. “One main challenge with sustainability in AM is not AM itself, but what it enables,” says Burger. “For instance, in oil & gas, AM plays a growing role in reducing downtime risks. One can argue that oil & gas is not very sustainable, but onsite production of spare parts surely contributes to sustainability.”

“Sustainability is definitely going to be a focus,” Mulherin agrees, “but there’s going to be a shift slightly more towards the business case behind sustainability. Rather than the marketing of sustainability or greenwashing, there is a large economic reason to focus on sustainability.”

Growth in On-Demand 3D Printing Services

Although not all of our experts agree, another continued trend in 2023 is the growth of on-demand additive manufacturers. These services will be relied upon by companies that have delayed their capital investments in printers or those testing the waters before they adopt 3D printing.

Many service bureaus have expanded offerings in 2022 to deliver design and engineering services and a broader menu of materials. Approving more 3D printing service bureaus to use high-performance polymers will be a key objective for Solvey Speciality Polymers in 2023, says Alexander.

“More service bureaus are covering the complete bandwidth of AM solutions and giving their clients the flexibility to shift from the one to the other production technology and material,” notes Burger, who anticipates continued growth in this area. “Companies do not always see the benefit of investing themselves in AM and deploying AM themselves.”

Rasch at Materialise (naturally) predicts that companies will save a lot of wrong investments and frustrations by “walking with bigger service bureaus before they run alone.”

3D printing-as-a-service has long been the gateway to additive manufacturing at larger companies and may expand its audience to midsize and smaller firms.

“Few people would buy a half-million-dollar printer without having ever printed something in a service bureau,” notes Mulherin. “Service bureaus are really a critical part of bridging the gap from prototype to production for companies.”

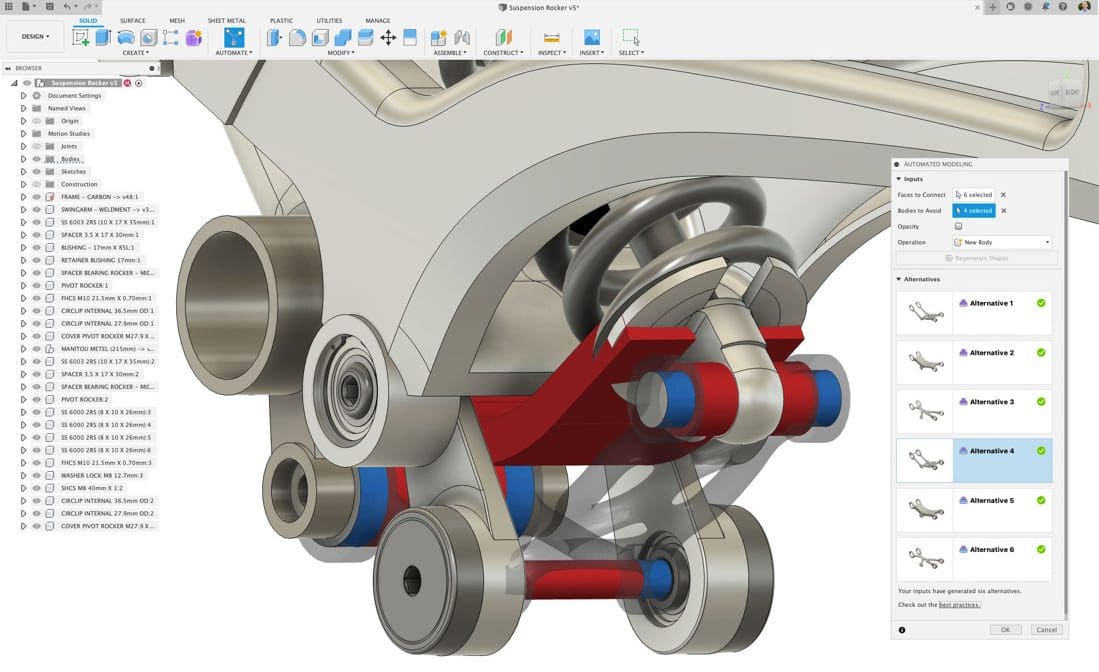

Growth of AI in AM

Artificial intelligence in AM is more alluring now than ever. Previously it was an intriguing promise, but today we’re beginning to see concrete applications in generative design and simulation software. “Software integration into additive, with an eye on AI improving many aspects of the workflow,” is on the horizon for 2023, says Carey.

Reliable process and quality control, a consistent hurdle to AM adoption, may be on the brink of a solution using AI to automate the most critical steps in the 3D printing process. Promising research into machine-learning systems that use computer vision to monitor the manufacturing process and fix print errors in real time may begin to make its way into products as early as 2023, the board predicts.

“We’ve dialed in the printers and the hardware as best we can,” says Mulherin, “and now the software, and AI-enabled software, needs to come in to take over in-situ monitoring and boosting reliability and repeatability.”

Focus on the Complete Workflow

The AM industry isn’t just 3D printers, of course, and our experts have noticed that the materials, software, and post-processing equipment markets all grew at a pace faster than the printing hardware in 2022.

“I believe that we’ll see more development outside of the printer in 2023, both pre and post-processing, workflow, automation, and connectivity,” notes Carey.

Supply Chain Solution

AM as a supply chain solution will continue to be one of the fastest-growing domains, our board says.

“We’re certainly at the stage of additive as a supply chain solution in terms of redundancy,” notes Krone. “The ability to keep yourself operating when inevitable supply shocks come. That’s here to stay.”

The supply chain bottlenecks were a wake-up call to manufacturers looking to reshore and localize their part production. Although additive will not replace traditional manufacturing in most instances, it will give manufacturers access to faster prototyping along with cheaper spare parts and custom tool production.

“I believe that we will still keep struggling with logistic issues in 2023, so flexibility in production will be an advantage,” adds Sylvia Monsheimer, head of industrial 3D printing at polymer maker Evonik.

What Hurdles Will Hamper Growth in 2023?

3D printer makers were not immune to their own supply chain issue for critical components for printers in 2022. A problem that may spill over into 2023.

Despite the pandemic easing, TranPham notes that many segments of the market will still be regrouping in early 2023. Beyond this, driving adoption in 2023 will continue to be outreach and education, our board agreed.

“Sometimes, in this industry, we are a little myopic because we sell to engineers, we think that all engineers know about 3D printing, and that’s not necessarily the case,” says Krone. “Everyone knows what a 3D printer is, but most engineers working in global enterprises don’t have enough knowledge of the latest technologies and materials to know how to implement them in their workflow.”

In addition to education, there’s still an aversion to trailblaze and general fear of change in the manufacturing industry.

“The engines are warm and the tank is full, but to fly the plane, you still need to reach a certain speed,” says Quental. “We are at the point where manufacturers are knowledgeable about AM, and are considering its inclusion into their manufacturing capacity, but there’s the normal inertia and caution in any structural transition.”

AM as a solution to production manufacturing will continue to experience hurdles, our experts agree. “Repeatability needs to improve and costs need to go down before AM is considered for production,” says Burger. “However, I do believe that AM for production in certain verticals, such as medical, will flourish.”

TranPham notes that the industry needs to implement integrated post-processing first to ensure quality and repeatability before production can be sold as a solution. “Everybody wants to go production,” he says, “but the market is not ready. It needs bigger players to come in and consolidate to produce true production solutions. Corporate giants like Nikon and Mitsubishi strengthening their positions in the market was an exciting development in 2022.”

Quental says automation and continuous production will become top priorities in 2023, whether or not we see new production or initiatives.

What Does the Industry Need Most in 2023 To Grow?

The All3DP Editorial Advisory Board is nearly unanimous that 2023 will present more challenges than 2022, but the major hurdles are familiar: education, innovation, and money.

Although manufacturers and machine shops are adopting AM at a record pace, what they’re using 3D printers for may not lead to strong market growth, says Alexander. “Rather than trying to cut 20% off costs by 3D printing existing parts, the aim should be a design that adds true value. Manufacturers won’t be able to replace something that is already working without a really strong reason.”

Success stories and use cases showing major savings and growth give companies that reason, so continued focus on use cases remains All3DP Pro’s major focus.

New Products & New Money

“The number one thing that all technology industries need to grow is innovation and access to capital,” notes Krone. Whether 2023 will deliver looks uncertain. Any degree of recession will indeed affect start-ups and their innovations in 2023 as funding from venture capitalists dries up, possibly leading to more industry consolidation.

We saw a lot of consolidation and strategic investment in 2022, which leads to the worry of AM becoming an industry dominated by a few very large companies. “Money is getting tighter and only large companies have the resources to survive,” notes Alexander. “I expect to see a lot of bubbles burst in 2023, especially if the recession really does hit. The first area where companies will cut costs will be on high-risk innovations, such as AM.”

TranPham notes that there’s still a lot of hype around additive manufacturing and “too many me-too products.”

“In a normal growing economy, these companies would push market growth and potentially all find their own space,” notes Quental. “In a downturn, however, it’s likely some won’t make it, and we may see another round of consolidation.”

Major Acquisitions in 2022:

- 3D Systems acquired printer makers Titian Additive, Kumovis, and DP Polar

- Stratasys bought the additive manufacturing materials business of Covestro and the software company Riven

- MakerBot merged with Ultimaker

- Markforged acquired binder jet printer maker Digital Metal

- Carbon acquired software maker Paramatters

Despite investment companies, like AM Ventures and Core Industrial Partners, focusing on 3D printing and manufacturing, there are not enough of these firms backing innovation in AM, notes TranPham.

“I feel for companies that need investment to continue,” says Mulherin, “because investors are going to be very, very gun shy in 2023. Investors are well aware of overhyping and are going to be a lot more diligent before giving people money.”

Focus on the Full Workflow

Certainly, 3D printing is about much more than printers. In the past three to five years, there’s been a focus on the complete workflow of the 3D printed part from CAD to post-processing in terms of both hardware and software. This will continue in 2023 with the added element of automation.

“I think there’s a new recognition of automation,” says Mulherin. “Automation is key, but I don’t think we’ve made any big breakthroughs per se, but we’re on the right path.”

2022 Predictions On the Mark!

No one wants to hear “I told you so”, but in this instance, it’s a good thing. Our editorial board predictions a year ago for 2022 were mostly spot on. You can reminisce at the link below.

Do you have projections for 2023? Please share in our comments section below.

Lead image source: Raise3D

License: The text of "2023 Additive Manufacturing Outlook: Industry Leaders on the Year Ahead" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.