The sky is not falling. Despite the low number of product launches in 2023, low OEM stock prices, some notable company consolidations (and attempts), and a sluggish economy affecting spending, the AM market is still expected (by the overwhelming majority of analysts*) to grow at around 20% in 2024 and, more importantly, interest in and application of 3D printing has never been higher.

To understand this dichotomy better and predict how it will play out in 2024, All3DP turned to its own pool of industry experts who sit on the All3DP Pro Editorial Advisory Board. Representing 3D printer OEMs, material makers, end-users, academia, consultants, resellers, print services, and engineers, the All3DP Editorial Advisory Board contributes to our additive manufacturing coverage year-round, but annually, we invite them to review the highlights of the past year and provide insights into the trends that will shape the next.

Why Are You Optimistic About Growth?

When asked to describe 2023, the board offered words like correction, regrouping, streamlining, and maturation.

John Barnes, president of The Barnes Global Advisors, a prominent additive manufacturing consulting firm headquartered in Pittsburgh, described the past year as a pivotal maturation step for the industry. “As a comparison, if you look at the automobile industry when it started, they were disruptive, needed different input to work which created a logistical challenge, and operated far differently than horses,” he says. “Perhaps 100 companies with different but great ideas coalesced into 10 or 20 globally, and we now enjoy the benefits like heated seats.”

In other words, we need to take the long view, Barnes says. “Early growth [in AM] was fueled by venture capital and government funds, not demand for parts.”

The current phase of growth, according to Barnes, is marked by a shift in focus toward the actual need for parts. This evolution has led to increased productivity in printers, coupled with a growing proficiency among engineers in designing for additive manufacturing — a shift from the disruptive to the integrative, comparable to the transition from riding a horse to driving a car.

So if we’ve created the car, how do we get more people to recognize the benefit of driving?

What the industry needs most are solutions, services, and partnerships to help end-users really get proficient with part identification, re-engineering (DfAM), qualification (materials and machines), distribution, production, and certification, says Jos Burger, a board member at 3YourMind on-demand manufacturing software and former long-time CEO at 3D printer maker UltiMaker. “Big end-users and OEMs are stepping up to play a role in these workflows.”

The adoption is already well underway, All3DP board members agree.

Kristin Mulherin, president of Women in 3D Printing and a veteran of several industry OEMs is now leading the additive initiative at the large electric industry manufacturer Hubbell. In her perspective, the enthusiasm among end-users for AM has never been higher. “People are ready for it now, but I don’t think they were a couple years ago,” she says. “I think companies are truly ready to adopt this technology because they see the real potential, and we’re starting to see true support from the end users, rather than the hype from the machine OEMs.”

As the 3D printing industry advances into 2024, industry experts anticipate a shift towards a more subdued and pragmatic approach, characterized by what Richard Grylls, a principal advisor at The Barnes Global Advisors, coins as “quiet adoption.”

Grylls envisions a landscape marked by less fanfare and hype, where individuals seamlessly incorporate additive manufacturing (AM) into their workflows where it makes practical sense. Grylls highlights the expanding applications across various sectors, from rocket engines to tooth retainers, hearing aids, defense parts, and tooling.

This perspective sets the stage for a nuanced exploration of the industry’s trajectory. Supporting this notion, Matthias Schmidt-Lehr, managing partner and founder of AM consulting firm Ampower, underscores the role of high-end application owners in driving market growth. He emphasizes that the momentum will not solely rely on research and development (R&D) efforts but will be propelled by the actual production of 3D printed components.

Schmidt-Lehr specifically points to the establishment of large-format metal laser powder bed fusion (LPBF) as a standard in industries like energy, aerospace, and defense, which is poised to unlock a host of intricate and high-performance applications.

The industry insiders on the All3DP Board have an ear for the plans and projects underway that the media may not see for a while. “I think there’s a lot more end use of AM in production that people are reluctant to talk about,” says Mulherin. “I think there’s a lot more going on behind the scenes and people are finally getting to the point where maybe they’re advanced enough in their process, that they might be willing to talk about it more in 2024.”

Topics & Trends Driving AM in 2024

There were no shortage of hot topics in additive manufacturing in 2023, ranging from mergers to AI and distributed manufacturing to sustainability. Some are relative blips on the radar while others made a lasting impact. The All3DP Board members picked out the most important topics we’ve been talking about in 2023 that will continue to drive conversations in 2024.

AI Will Change Everything, But Not Yet

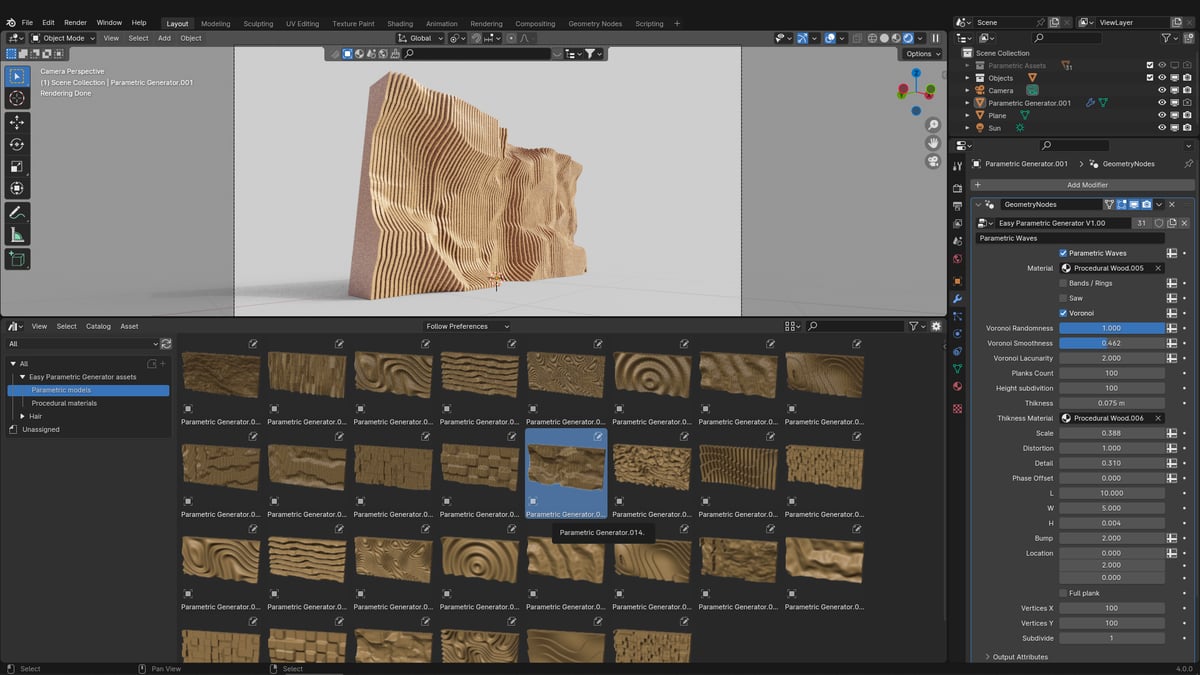

AI is tomorrow, software is today, the Board agreed. Eventually, machine learning will make designing parts for 3D printing far easier and more accessible to people without deep engineering skills. It will become faster and cheaper, which will spark a sea-change in the industry. But this won’t happen in 2024.

AI has the potential to dramatically assist in design of common parts for 3D printers. Software to enable part creation with a few sliders and a few verbal or written queues could cut 90% of the design time for common parts. “I think AI and data creation will begin to be in market in 2024,” says Krone, and not just for the top industrial end of the market, but for everyone.

Addressing the current gap in intuitive design software, Mulherin emphasizes the potential for widespread adoption of 3D printing at the prosumer level if a more user-friendly solution emerges. “If a software company can come out with something that’s more intuitive for design, there’d be a huge spike in the adoption of 3D printing.”

The more immediate need in software, the board agreed, is process software: tools that make the end-to-end workflow of AM parts easier. With more integrated software to make the process chain more complete (design, printing, post processing, certification, automatization) additive manufacturing would be on par with other manufacturing technologies.

Materials Will Become a Bigger Reason to Choose AM

Material development was one of the bright spots in 2023 reflecting a broadening menu of polymers available, new specialty medical and dental resins, and some sustainable innovations in both polymer and metal powders.

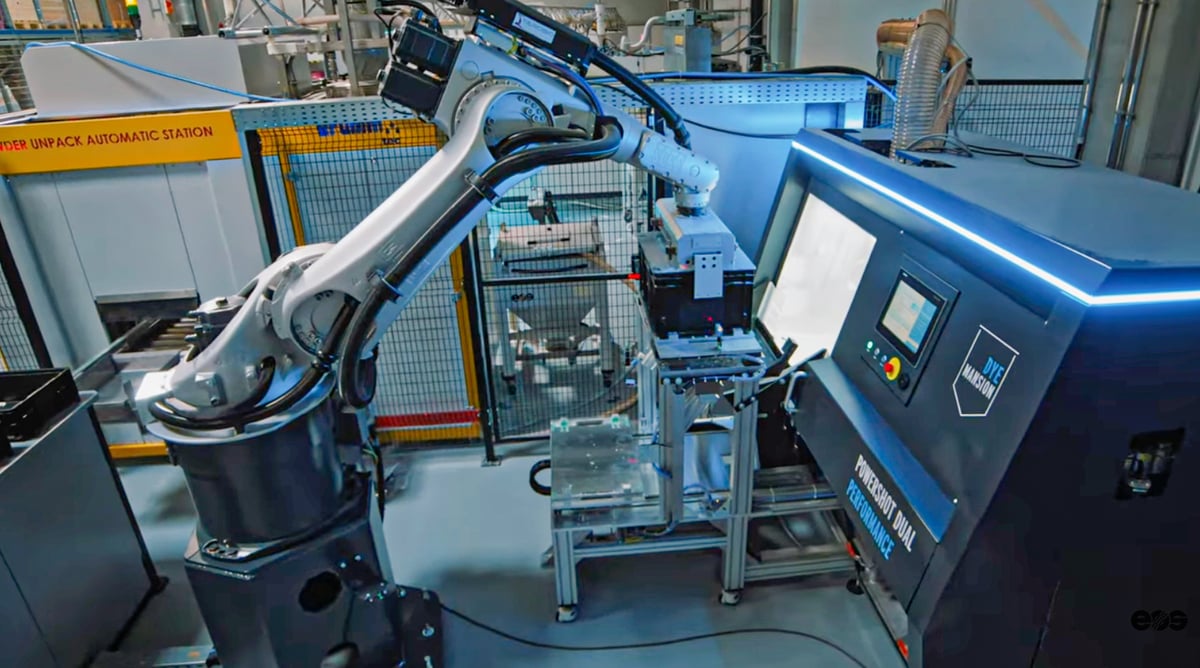

“I predict the powder movement and management will be rethought to access more powders and the ‘religion of the round’ will dissipate,” says Barnes, who is also the CEO of metal powder producer Metal Powder Works. “Newer inventions in how we make powder are challenging how we design 3D printers in the first place.”

Brian Alexander, the global AM product and business development manager at Syensqo, formerly Solvay Specialty Polymers, is excited about the continued growth of pellet materials. “The printing of granules will eventually replace filaments, and 2023 saw a rise in new FGF [fused granule fabrication] or PBAM [pellet-based additive manufacturing] printers.” High performance polymers in pellet from will take time to adopt, he cautions, but the lessons have already been learned through the filament production. “A challenge for material suppliers like Syensqo will be to adapt their materials to pellet printers, and eventually scale up to LAAM [large area additive manufacturing] by developing materials with larger processing windows and lower warpage.”

Sustainability Is As Significant As Ever

Emphasizing the significance of sustainability, Krone highlights its relevance for both environmentally conscious consumers and Fortune 1000 companies with overarching carbon targets and sustainability objectives. According to Krone, the emphasis on sustainability manifests in two distinct ways. “One is the fact that people do try to choose the more sustainable option, whenever possible, for a lower carbon footprint. Secondly, while it is true that sustainability is a marketing buzzword that companies like to mention, it nonetheless causes them to take actions in the right direction.”

Yet, in times of great fluctuation and economic constraint, goals, such as sustainability can get pushed to the background.

“I think whether it’s sustainability or diversity, there’s a heavier focus when times are good than when times are bad, it’s the first thing to go,” says Mulherin. “So I think I’d be shocked if sustainability was as hot a topic in the coming year.”

Yet, if sustainability were to shift to the background it wouldn’t be for long. The next generation of AM engineers are coming from an environment, and a mindset, that’s heavily focused on sustainability.

“As our university, sustainability is really at the core of what we do,” says Carl Diver, director of PrintCity at Manchester Metropolitan University. “We’re not just talking about sustainability, we’re doing it and consistently doing it over the last 10 years from government funded research projects with sustainability at their core to producing our own recycled filament from waste coffee pods and plastic bottles.”

Confidence & Optimism Going Into 2024

There is no denying that the Wall Street view of additive in 2023 was dismal, and the industry had a lack of significant technological breakthroughs, and for most 3D printing OEMs sales growth was below budget, but, as Krone points out: “What’s also true is that on the ground in the day to day world of people who actually use 3D printers, they continue to rely more and more on additive.”

In fact, it’s very important to mind the gap between what Wall Street does and what Main Street does, notes Krone. “In the real world of 3D printing users, utilization reached its highest level ever in 2023 and will clearly be growing in 2024.”

Krone’s optimism for 2024 comes in part from actual sales volume at Dynamism, which sells both consumer and professional 3D printers and materials. “In 2023, we had large budget deals get pushed down the line, but from the fourth quarter of 2023, we’ve seen a real pickup in large scale spending, aka industrial additive. Big companies with end-of-year budgets are feeling confident going into 2024.”

No only does the Board agree that business adoption is growing and maturing, but consumer sales of 3D printers are steadily rising as is the number of programs at higher learning institutions covering additive manufacturing and advanced engineering.

“Every year, an entire graduating class of engineers enters the workforce. But unlike a decade ago, they are native in 3D printing — most of their STEM education, projects, and critical thinking is heavily additive-influenced,” notes Krone.

Diver, at Manchester Metropolitan University, sees these next-generation engineers every day and says their interest in AM and their confidence that they can build a careen in it, has never been higher. On the business side of PrintCity, which helps area companies explore and implement additive manufacturing solutions, “it’s never been busier,” he says. “We’re seeing more and more interest from companies, and not just engineering or manufacturing companies, but a wide range of businesses.”

Diver says the companies he works with at PrintCity and the type of programs offered have changed as the perception of additive moves beyond prototypes. “More businesses believe that additive is a tool that, if harnessed and done properly, can actually optimize their processes. So I’m feeling quite positive.”

What New Developments Will We Actually See in 2024

After the relative drought of new hardware in 2023, the Board expects to see a correction in 2024 that might center around the prosumer desktop market.

“I expect strong growth in the $15k to $25k segment with much better and more reliable machines,” says Burger. “Dominated by manufacturers that successfully position their machines in professional workflows, in on-demand and local production of (spare) parts, supported by strong partnerships with software and services companies and industry initiatives like Pelagus [the digital catalog of maritime spare parts].”

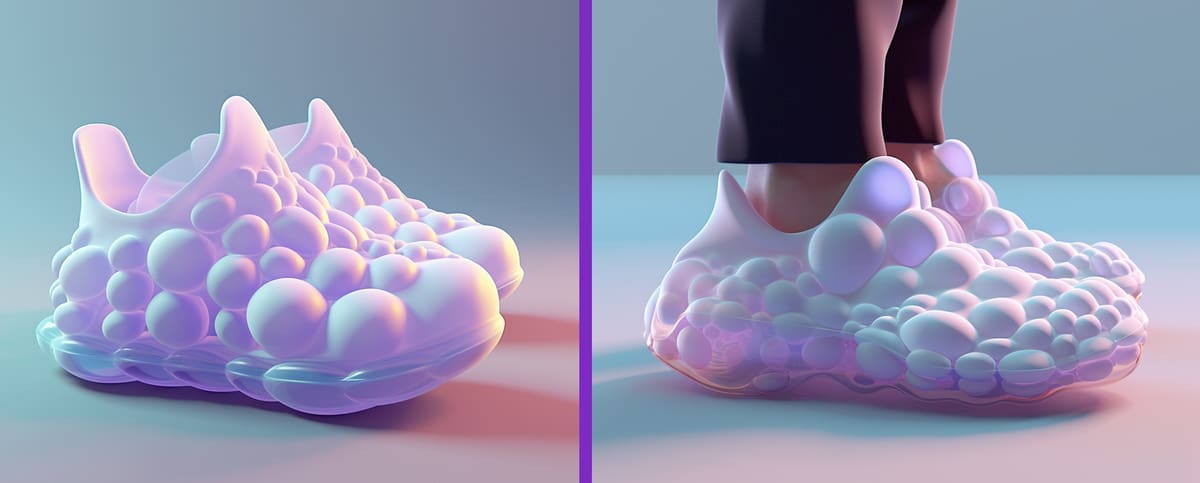

When it comes to market verticals and applications, Schmidt-Lehr sees high growth in motorsports, dental implants, space applications, energy, and civil engineering emerging from long qualification efforts coming to fruition. More modest growth is expected in footwear, construction, and among small manufacturers, he says.

As additive manufacturing continues to establish itself, large manufacturers are seeing the potential and entering the market.

“It was great to see Nikon entering our space,” says Tuan TranPham, industry influencer and former chief revenue officer at Azul 3D, “but we need more big boys to enter the market and we need to retain companies like HP and GE.” In 2024, Tuan says we’ll see consolidation opening space for new companies to emerge, AM service bureaus will specialize even more, and Chinese OEMs with quality products might grab a chunk of market share.

Machine manufacturer consolidation is inevitable as the market matures, the Board agreed, while the most innovative software companies will be acquired and assimilated into AM ecosystems.

Barnes reflects the Board’s sentiments when he says: “The sun is not setting on our industry, it’s rising for a new phase.”

2023 Predictions On the Mark!

No one wants to hear “I told you so”, but in this instance, it’s a good thing. Our editorial board predictions a year ago for 2023 were mostly spot on. You can reminisce at the link below.

Do you have projections for 2024? Please share in our comments section below.

_____________________________________________

* Analysts projections of additive manufacturing growth:

- Global market size for industrial additive manufacturing is expected to grow from $3.83 billion in 2023 to $16.93 billion by 2030, at a compound annual growth rate (CAGR) of 23.6%. Source: Research And Markets.

- In 2023, the global industrial additive manufacturing market size reached approximately $13 billion. The market is assessed to grow at a CAGR of 20.9% between 2024 and 2032. Source: Expert Market Research

- The global additive manufacturing market size was evaluated at USD 15 billion in 2022 and it is expected to hit around USD 95.62 billion by 2032, poised to grow at a CAGR of 20.4% during the forecast period 2023 to 2032. Source: Precedence Research

- Core polymer AM market generated $4.6 billion in 2021. Market expected to grow to over $34 billion by 2030 at 24.8% CAGR. Core metal AM market generated over $2.8 billion in 2022. Market expected to grow to over $40 billion by 2032 at 30% CAGR. Source: VoxelMatters

License: The text of "Additive Manufacturing Outlook 2024, the Argument for Optimism" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.