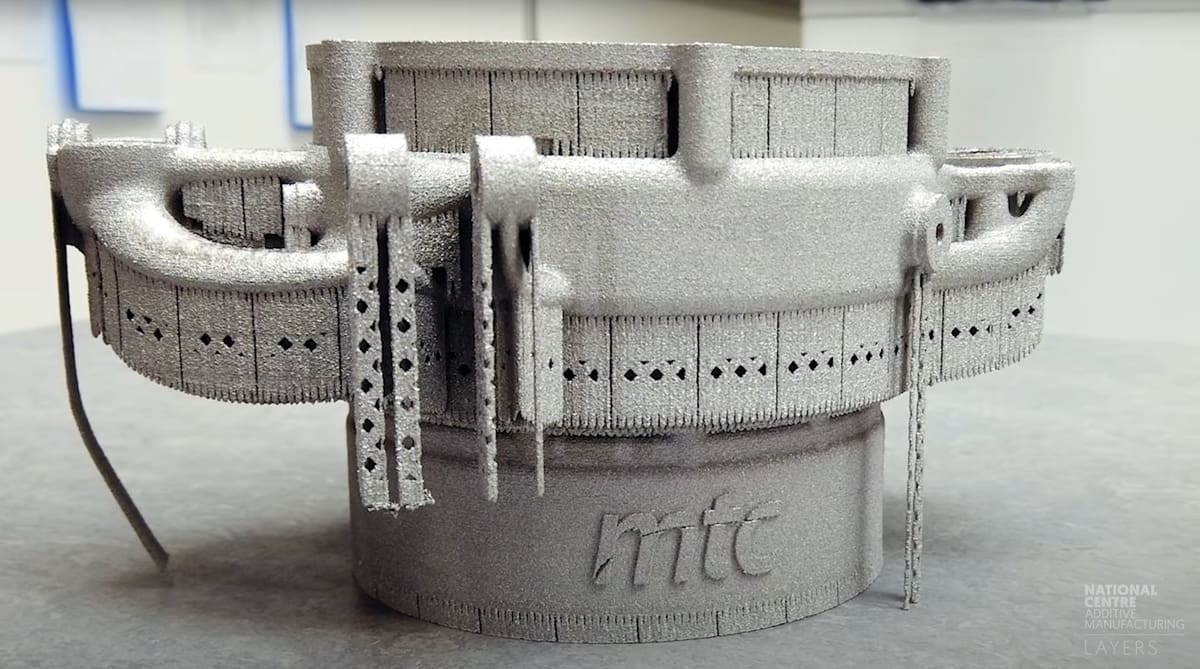

Electron beam melting (EBM), or electron beam powder bed fusion (EB PBF), uses a high-powered electron beam to melt conductive metal powders like copper and titanium together layer by layer. The resulting parts are highly dense and mechanically strong, finding a use in everything from turbine blades to hip implants.

If the metal powder bed fusion market were a biblical story, the electron beam would be David and the laser Goliath, albeit much more powerful. Since its introduction as an additive manufacturing technology at the end of the 20th century, the electron beam has always played the second fiddle as it watched laser powder bed fusion (LPBF) slowly mature into commercialization.

But electron beam melting is slowly gaining traction for its unrivaled abilities. “Over the past 2 to 3 years more than half a dozen new players entered the market for EB PBF machines enabling new sourcing options for the industry,” says Maximilian Munsch, managing partner at additive manufacturing thinktank and consulting firm Ampower. “This renewed the awareness of the technology, which comes with advantages over LPBF in certain areas such as processing of materials at highly elevated temperatures, should result in new machine concepts and increased R&D efforts on materials and processes.”

Will the story eventually conclude with David wielding his mighty electron beam to topple over the AM industry giant that is laser powder bed fusion?

Recent years have seen an unprecedented number of players entering the EBM industry, from small garage-shop spin-offs to multinational corporations, all rushing in to grab a slice of the powder cake. After almost 20 lonesome years as the only OEM, Arcam AB (now Colibrium Additive) has to compete with seven new companies that popped up within less than a decade. This isn’t a meteoric rise by any means, but clearly demonstrates the heightened interest in the technology.

Ampower expects the overall increase in EBM competitive landscape in the coming years will make new applications economically and technically viable and increase the share of EMB systems in the powder bed fusion market.

Another trend toward open systems and machines specifically designed for the sole purpose of material development is also noticeable. The current industry appears to embrace a more open approach to knowledge creation and sharing, likely as a strategy to help the EBM market reach maturity as quickly as possible and collectively benefit from the resulting business opportunities. Freemelt exclusively offers a materials development system, while Wayland Additive, QBeam, and Xi’an Sailong Metal offer customized, open machines for powder research and development.

If we were to choose one company in particular with the potential to disrupt the current technology landscape entirely, it would be Wayland Additive and its proprietary NeuBeam technology. Using charge neutralization that eliminates the need for pre-sintering, the British startup claims it is able to vastly speed up the process and eliminate powder caking. Should the two machines that are currently installed as pilot projects deliver on their promises, EBM’s capabilities and limitations would need to be redefined entirely and may truly open up a “third way” of powder bed fusion, as the company puts it.

In a nutshell, there are exciting times ahead for electron beam-based additive manufacturing, with a never-before-seen pioneering spirit of newcomers and veterans alike.

Let’s take a closer look at EBM today, including how it works, the pros and cons, popular application areas, system manufacturers, and the technology’s future.

The Basics of Electron Beam Melting

Electron beam powder bed fusion was invented at Gothenburg University in Sweden and commercially pursued by the resulting spin-off company Arcam AB, which remained the only supplier of EBM machines until 2013. Arcam was acquired by GE Additive in 2016 and rebranded as Colibrium Additive in April 2024.

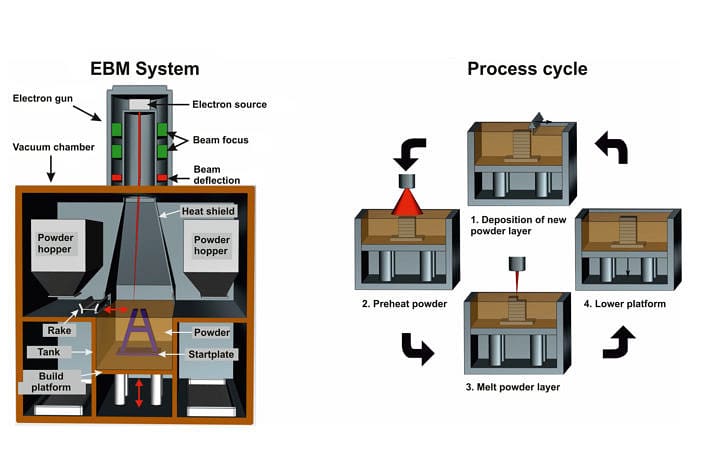

Like its fiercest competitor LPBF, the process is classified as metal powder bed fusion but uses an electron beam instead of a laser to melt the layers of powder together.

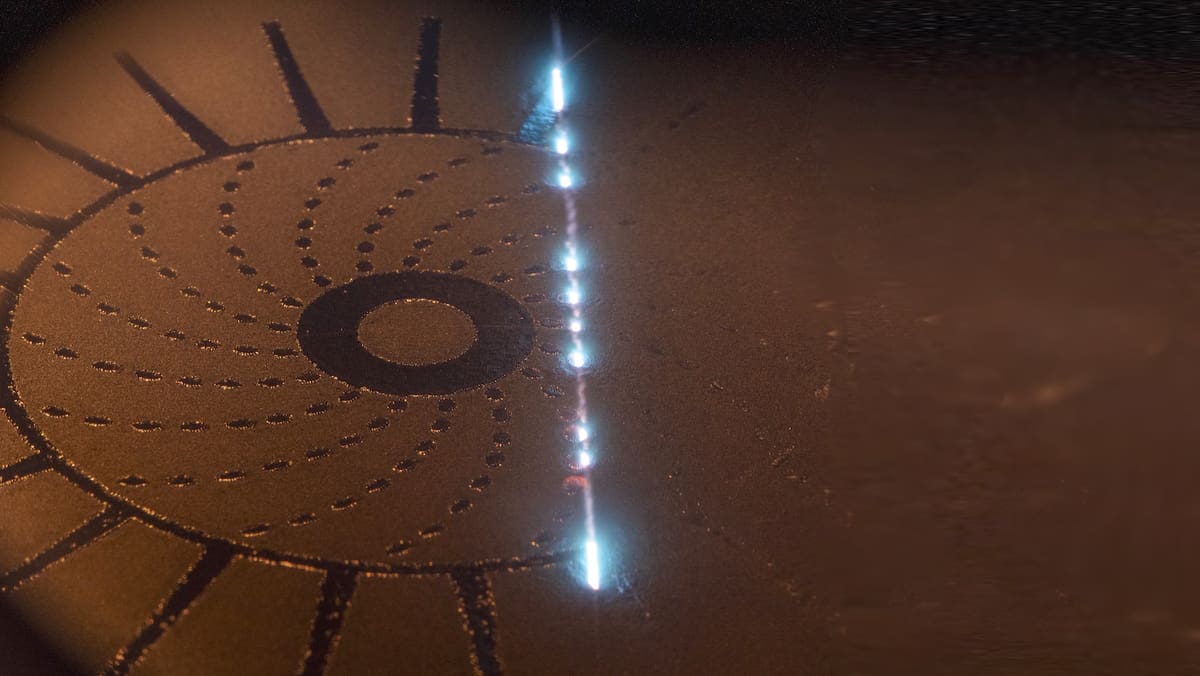

This is also how the technology got its name, resulting in some unique process characteristics compared to LPBF. For example, instead of an inert gas environment, EBM takes place in a vacuum to prevent beam scattering and can be classified as a “hot” process, where the build chamber temperature can be heated up to 1,000 °C and in some cases even higher. This is possible because the electron beam is a lot more powerful than the standard PBF laser. Since it uses electromagnetic beam control, it is also able to move at higher speeds and can even be split up to expose several areas at once. Like this, the beam can “pre-heat” every layer before starting the actual melting process.

During printing, the surrounding powder “cakes” around the part, theoretically eliminating the need for support structures. This leads to the common belief that EBM does not need supports at all. However, due to high deformation stresses, some supports are still needed to dissipate heat away from the molten material or to attach parts to the build platform.

Because of the beam’s nature, material choice is limited to conductive metals and alloys, most prominently titanium, aluminum, copper, nickel, and steel. However, the rekindled interest in EBM means that further materials are developing. The strategy to expand powder choices is also reflected in the many machines that are designed specifically with materials research and development in mind.

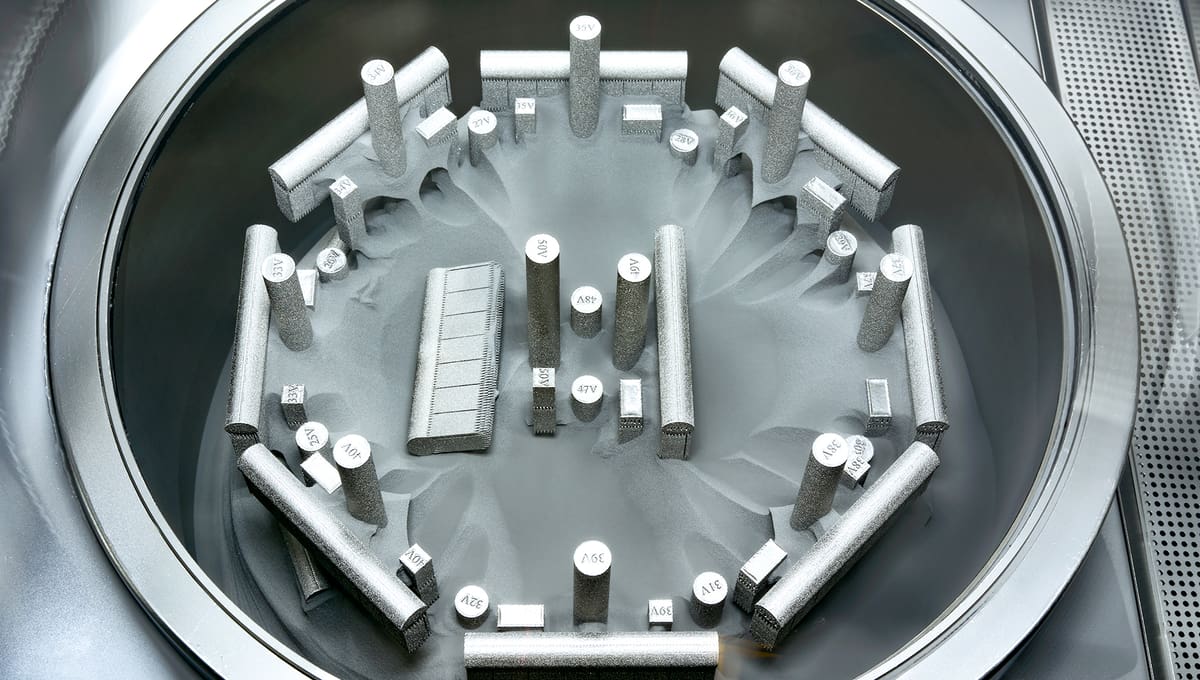

A major benefit of EBM is the ability to “stack” separate parts on top of each other as they do not necessarily have to be attached to the build plate. Productivity can be greatly increased as machine downtimes and post-processing are reduced.

One of the oldest and most successful EBM applications is the manufacture of acetabular titanium cups for hip replacements. For example, Amplify Additive managed to reduce time to market from traditional manufacturing by up to 58%, managing to build 54 cups (pictured below) in a single build compared to 12 in a comparable laser setup.

The company states: “EBM is a clear winner when it comes to additively manufactured acetabular cups. The EBM process allows for maximum use of the build volume by stacking parts. Parts are removed by hand and have material properties exceeding ASTM standards (F2924, F3001).”

However, this ability also comes with drawbacks. The finished build must be left to cool down before extracting the parts. Due to the powder “caking”, internal channels and other cavities will be hard to clean out, limiting design freedom compared to laser PBF. The unmolten powder that can be removed via blasting has a recyclability rate between 95 and 98%.

Electron Beam Powder Bed Fusion Pros & Cons

This list summarizes the already mentioned as well as some additional benefits of EB PBF.

- Ability to process high-temperature, crack-prone, and reflective alloys

- High part density

- Homogenous microstructure and superior mechanical properties

- Minimized need for heat treatment

- Unused powder is 95-98% recyclable

- Depending on the application, it can be faster than LPBF

- Fewer supports required compared to LPBF

There are, however, also some drawbacks to the 3D printing technology:

- Limited print volume (max. 350 mm diameter and 430 mm height)

- Limited material selection

- Expensive machines and materials

- Poor surface finish before post-processing

- Internal channels or cavities need to be easily accessible, otherwise the sintered powder can not be removed during post-processing.

- Less detail resolution compared to SLM. This is because the electron beam is larger in size, but also because a coarser powder and thicker layers are usually used in EBM

- Need to cool down parts before removal

- No multi-material option as of today

- Cathodes that generate the electron beam need to be replaced regularly

- Vacuum takes a long time to build up

Commercially available metals used in electron beam melting are:

- Titanium and titanium alloys

- Cobalt chrome

- Copper

- Nickel alloy

- Tool steel

- Stainless steel

- Tantalum and titanium tantalum alloy

Who's Using Electron Beam Melting Now?

Electron Beam Melting for Medicine

As medical devices like orthopedic implants continuously increase in complexity, EBM enables more design freedoms while at the same time achieving the medical sector’s requirements for excellent mechanical properties.

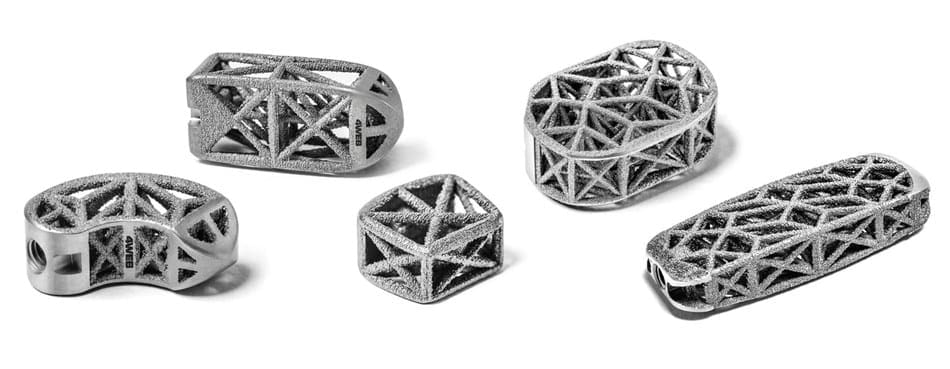

In addition to acetabular cups, other large orthopedic implants like femoral knee components, tibia trays, knee joints, and spinal cages are manufactured on EBM machines. 4WEB Medical, for example, manufactures a portfolio of spinal truss implants that are based on multiple design integrations and work on the principle of mechanobiology: “The emerging field of science at the interface of biology and engineering that focuses on how physical forces and changes in the mechanical properties of cells and tissues contribute to development, cell differentiation, proliferation, and healing.”

Electron Beam Melting for Aerospace

Besides medical implants, the aerospace industry presents another major market for electron beam melting. Turbine blades for jet engines used in all kinds of private, commercial, and military aircraft are manufactured at scale with the technology. Jet engines that are equipped with these 3D printed blades include the LEAP, GEnx, GE90, and GE90, lifting airliners like the Boeing 777, Dreamliner, and 747-8 into the sky. One of the central companies responsible for this engineering feat is Avio Aero from Italy, who worked together with Arcam and GE to make this possible.

The secret to the blades’ success lies within EBM’s ability to process high-temperature and crack-prone materials like titanium aluminide (TiAl), which is 50% lighter than the nickel alloys that blades are usually made out of. A full set of 3D printed turbines can shave off up to 20% of the engine’s weight, which equals a quantum leap in aviation. Moreover, the powerful electron beam can melt layers that are much thicker than those of its biggest competitor, laser powder bed fusion, making it the faster and therefore more productive choice for this application.

Electron Beam Melting for Industry

One of EBM’s advantages over L PBF is its ability to process very pure metals with no porosity or oxidation. GH Induction, a manufacturer of specialized equipment and machinery for industrial induction heating, uses this to its advantage and manufactures copper coils with 99.99% purity. These coils branded under the 3D Inductors product line can reach a service life that is up to 400% longer than that of conventional counterparts while benefitting from the design freedom that 3D printing offers.

According to the company, it holds the record for the largest 3D printed copper coil, built on a customized Arcam system with a doubled z-height of 350 mm. The stacking of parts in one build envelope is another unique process characteristic of EBM that helps GH Induction to further optimize manufacturing productivity.

The company claims that it can manufacture any coil geometry and even combine AM and conventional parts for a more cost-effective treatment solution. Use cases include coils for the heat treatment of crankshafts, hubs and spindles, drivelines, slewing bearings, and much more.

Electron Beam Melting 3D Printers

Colibrium Additive (GE Additive)

When US industry giant General Electric acquired the lone wolf Arcam AB and its EBM machines in 2016 it kept the Arcam name until April 2024, when GE launched a stand-alone additive manufacturing division called Colibrium Additive. The new wing is where you’ll find former Arcam machines along with the company’s metal laser powder bed fusion machines.

Q10plus

A small machine optimized for medical implant production, offering improved surface finish and high resolution. It has an electron beam power of 3 kW and build envelope of up to 200 x 200 x 200 mm. The machine is able to process titanium Ti6Al4V grade 5 and 23, Ti grade 2, cobalt chrome, and pure copper.

Spectra L

The Spectra L offers a build volume at Ø 350 x 430 mm and powers a 4.5 kW electron beam with advanced control, reducing cost per part by up to 20% compared to previous Colibrium Additive machines. The machine is built both for productivity and the manufacturing of bulky parts. Available materials are Titanium Ti6Al4V grade 5 and 23.

Spectra H

With Spectra H’s high-heat capability from its 6 kW electron beam, users can incorporate new alloys into production to expand their offerings, including high-temperature, crack-prone materials. The Spectra H has the capability to produce parts at temperatures exceeding 1,000°C. The machine’s enhanced capacity is opening up new opportunities to produce high-integrity parts larger and faster than ever before, the company says. Build volume is Ø 250 x 430 mm.

JEOL

JEOL has entered the additive manufacturing game with more than 70 years of electron optics experience under its belt. During RAPID 2022, the Japanese company which is usually known for electron microscope and semiconductor manufacturing equipment unveiled its first electron beam machine, the JAM – 5200EBM. Albeit its name that’s far from catchy, it caught visitors’ attention due to its innovative helium-free vacuum technology, resulting in a long-life cathode that they claim can stay operational for more than 1,500 hours, longer than any other machine on the market.

The JAM – 5200 EBM operates with a maximum beam power of 6 kW, has a Ø 250 x 400 mm build volume, and can process materials like titanium, nickel alloys, and pure copper.

Leveraging expertise from their electron beam lithography department, the machine also features an automatic electron beam correction, which reportedly narrows the spot shape and therefore improves process stability and accuracy.

Wayland Additive

Overcoming restrictions of current EBM processes is what Wayland Additive, a company operating out of Huddersfield, UK, says it brings to the table. Through their proprietary NeuBeam technology they tackle several major pain points of traditional EB PBF.

In conventional powder-based EBM, powder particles around the melt pool will statically charge and end up repelling each other, creating a “smoke event” that obstructs the laser and impacts process stability. The common solution has been to pre-sinter the powder to make it conductive and transfer the charge away from the electron beam. Wayland’s NeuBeam Technology on the other hand uses ions to neutralize these charges at the source. This transforms EBM into a “hot part” rather than “hot bed” process as pre-sintering of the entire powder layer is no longer necessary. The company maintains that it has eliminated the powder caking issue while still being able to build support-free and stress-relieved parts, an achievement that could potentially revolutionize the industry.

Wayland Additive offers one system, the Calibur3. Standing at 3 meters tall, the machine comes with a 300 x 300 x 450 mm build volume and a 5 kW electron beam. The company claims that all common metals and alloys used in AM can be processed with NeuBeam technology and that the open system promotes the development of new process parameters.

Their offered in-process monitoring solutions like structured light scanning, electron imaging, and high-speed infra-red cameras will substantially help in streamlining material development efforts.

Freemelt

Founded in 2017, Freemelt is another Swedish contender in the EBM market with one of the founders having previously worked at Arcam AB. What makes this company truly special is its open platform approach.

This is based on the company’s idea that in order to achieve large-scale market adoption, metal 3D printing needed to be opened up by sharing system and system user interfaces as well as build processors to ensure faster development and growth. Their first machine, the Freemelt ONE, was first marketed as a means to achieve those goals rather than as a stand-alone production machine.

The Freemelt ONE has a variable beam power of up to 6 kW, a build volume of Ø 100 x 100 mm, and, as it is an R&D machine, is open to any conductive metal.

Freemelt now offers two other open source machines: the e-MELT-iD and the e-MELT-iM, the difference being that the latter is made for large scale production whereas the former is geared towards individual product development. Because the two machines are so closely aligned, parts developed using the e-MELT-iD can quickly and seamlessly be scaled to high-volume production.

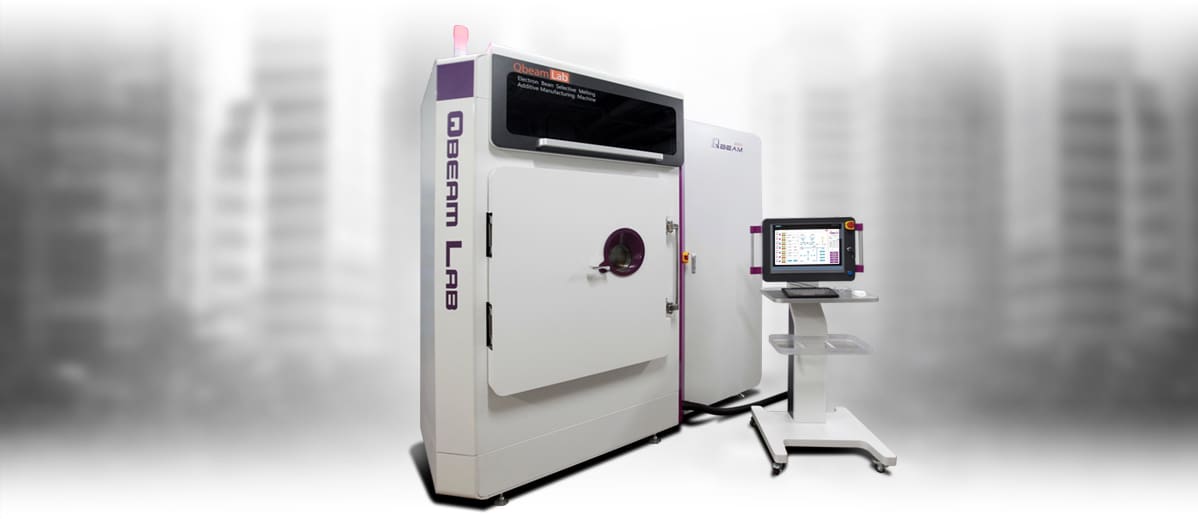

QBeam

With Chinese manufacturer QBeam, another university spin-off has entered the EB PBF space. Founded in 2015, the company already offers a portfolio of three systems, although two are based on the same machine but focus on different sectors.

QBEAM Lab200

Like Freemelt’s ONE, this machine is designed for material research and development. It has a build size of up to 200 x 200 x 240 mm and a 3 kW beam. Any conductive materials can be processed, including titanium alloys, superalloys, copper alloys, and refractory metals.

QBEAM Med200

The QBEAM Med200 is optimized for medical orthopedic implant manufacturing with improved manufacturing accuracy and efficiency. The specs are similar to its material developments counterpart at 200 x 200 x 240 mm maximum build size and a 3 kW laser. The machine can process titanium alloy.

QBEAM Aero350

Specifically targeted at the aerospace industry, the system offers improved energy density, enhanced energy absorption, and makes higher powder bed temperatures possible. At a build size of 350 x 350 x 400 mm and beam power of up to 3kW, it is the company’s largest machine and can process titanium alloy, titanium-aluminum intermetallic, nickel-based superalloy, copper alloy, and refractory metals.

Xi'an Sailong Metal

Another Chinese player that has developed more than 40 different metal powders, as well as two production-ready machines, is Xi’an Sailong Metal:

Sailong-Y150

The Sailong-Y150 has a sleek design with several interesting features, specifically crafted for biomedical applications. These include a finer beam spot diameter, no need for linear cutting from the build plate, and active cooling for faster part removal. The maximum part size is 170 x 170 x 180 mm with an electron beam power of up to 3 kW. Materials include titanium alloy, cobalt chromium, tantalum, titanium tantalum alloy, and others.

Sailong-Y150 PLUS

The Sailong-Y150 Plus is similar to the Y150 but made for manufacturing more precise and complex parts, such as implants, in smaller batches. Enhancements to this model include electron beam spot of ≤100 μm (as opposed to ≤300 μm), a filament lifespan of more than 500 hrs (formerly 60), and double the accuracy of the Y150.

Sailong-T200

Similar to the Y Series in that this EBM is well suited for manufacturing precise medical grade products, the T200 is larger than the other two machines and has a bigger build size of 200 x 200 x 450 mm. It’s electron beam power of 6kW is double that of the Y-series. Similar to the Y150Plus, this machine has an indirectly heated tungsten cathode and an electron beam spot of ≤100 μm for high precision printing, but like the Y150, components have an accuracy of only ±0.2 mm.

Sailong-H400

Has an even larger build size – 400 x 400 x 400 mm than all of the other machines, but has accuracy of only ±0.3 mm. This machine is more suited for manufacturing larger parts or mass production of smaller parts, such as those required for the aerospace industry.

Pro-Beam

German metal processing expert Pro-Beam entered the AM EBM market in 2021, when it unveiled the powder bed fusion PB EBM 30S. With almost 50 years of electron beam and laser processing experience from welding, drilling, and hardening, the company had finally ventured into additive manufacturing and could potentially cause some stir in the EBM sector.

The PB EBM 3OS is designed to manufacturer small, highly detailed metal components. The machine features what Pro-Beam calls its unique spot strategy that enables a controlled and customized heat distribution. The 3OS is an open system, meaning that operators have access to all parameters, a transparency that Pro-Beam says guarantees flexibility.

Another feature is the in-situ monitoring providing high-contrast images during construction for quality control.

The electron beam max output is up to 15 kW and the max build size is 300 x 300 x 400. Available materials include Inconel, copper, steel, titanium, and aluminide.

Mitsubishi Electric (TADA)

TADA is the second Japanese company to commercialize an EBM machine in recent years. A subsidiary of Mitsubishi Electric, TADA Electric, developed the EZ300. So far there’s very little information on it, but it has a maximum modeling size of 220 x 220 x 300 mm an electron beam output of 6 kW, and supposedly a long cathode life of 1,000 hours.

Only time will tell if this machine will manage to leave its mark in the industry, but carrying a household name like Mitsubishi on its hood will surely help.

Future of Electron Beam Powder Bed Fusion

The future of electron beam melting is bright. There are certainly exciting times ahead for electron beam melting, which is also benefitting from the current interest in additive manufacturing as a whole, leading companies with deep knowledge of electron beam technology to enter the field. However, as technological innovation often does fall short of its promises in a real-world environment, only time will tell whether EBM will position itself as a dominant manufacturing process in the future.

License: The text of "Electron Beam Melting (EBM 3D Printing) – The Complete Guide" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.