For insights into the additive manufacturing market worldwide, including the printers, technologies, and materials that are most in demand, companies turn to the annual Ampower Report on Additive Manufacturing.

I sat down with Matthias Schmidt-Lehr, industry thought leader and CEO of Ampower, the company that publishes the annual report, to talk about the most notable findings. What he revealed is good news for the industry and some surprises for end users.

The Ampower Report is independent, not funded or sponsored by manufacturers, and is a comprehensive view of not only the printers and technologies that manufacturers are producing, but also what end users are buying today, and what they say they want and need in the future. The data is based on hundreds of personal interviews with system suppliers, material suppliers, service bureaus, and users of additive manufacturing covering all AM technologies in metal and polymers. The system suppliers that contributed represent over 90% of the worldwide installed base of additive manufacturing machines.

Q. The additive manufacturing industry took a beating from the global pandemic. Are its effects over?

Yes, the first big new thing to say is that there’s growth again in the AM industry. From 2019 to 2020 we had almost no growth, just 0.5% in metals. From 2020 to 2021 the market regained its strength and we saw 23% growth in the metal AM sector and around 16% growth in polymers.

The longer term outlook however is going down a bit. It’s not the 30% annual growth rate the market projected before the pandemic. It’s now 25% for metals for 2023 and beyond, and 18% for polymers.

Q. Why the lower outlook for future growth? Was the market too optimistic before the pandemic?

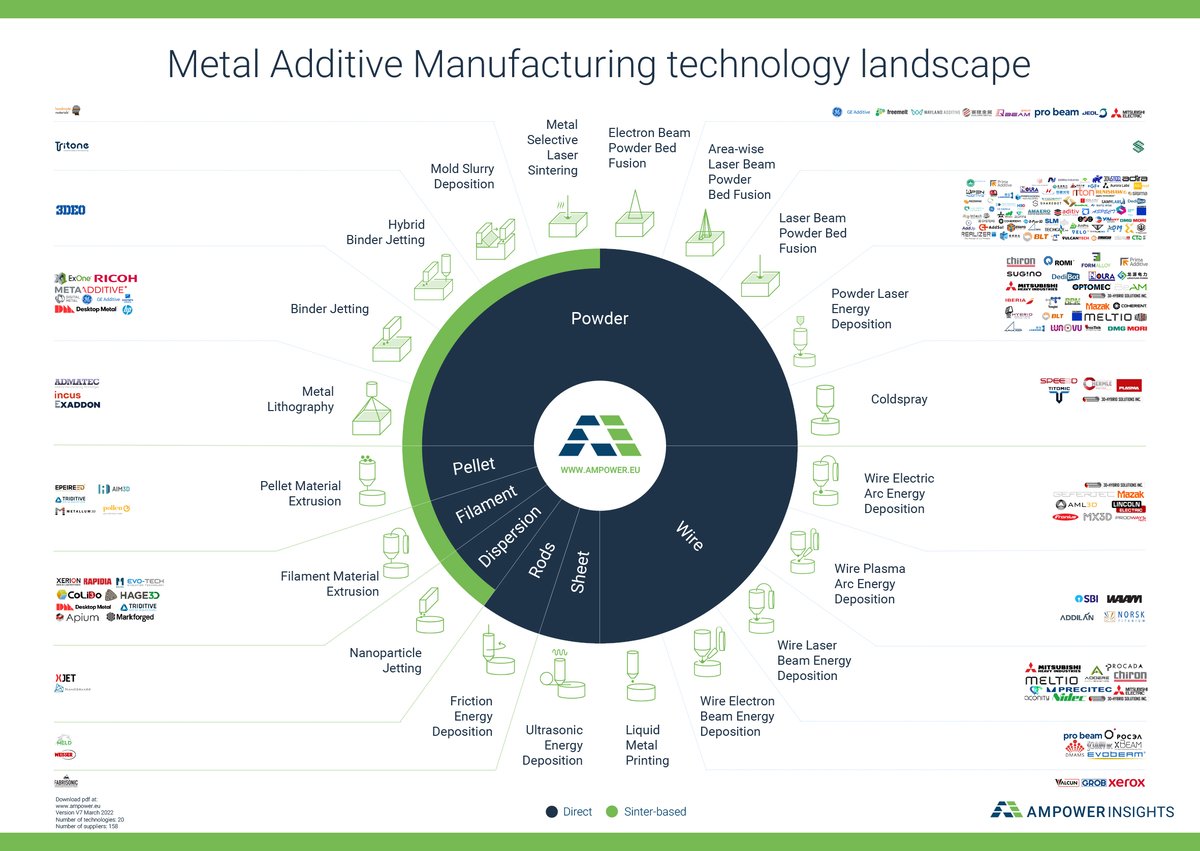

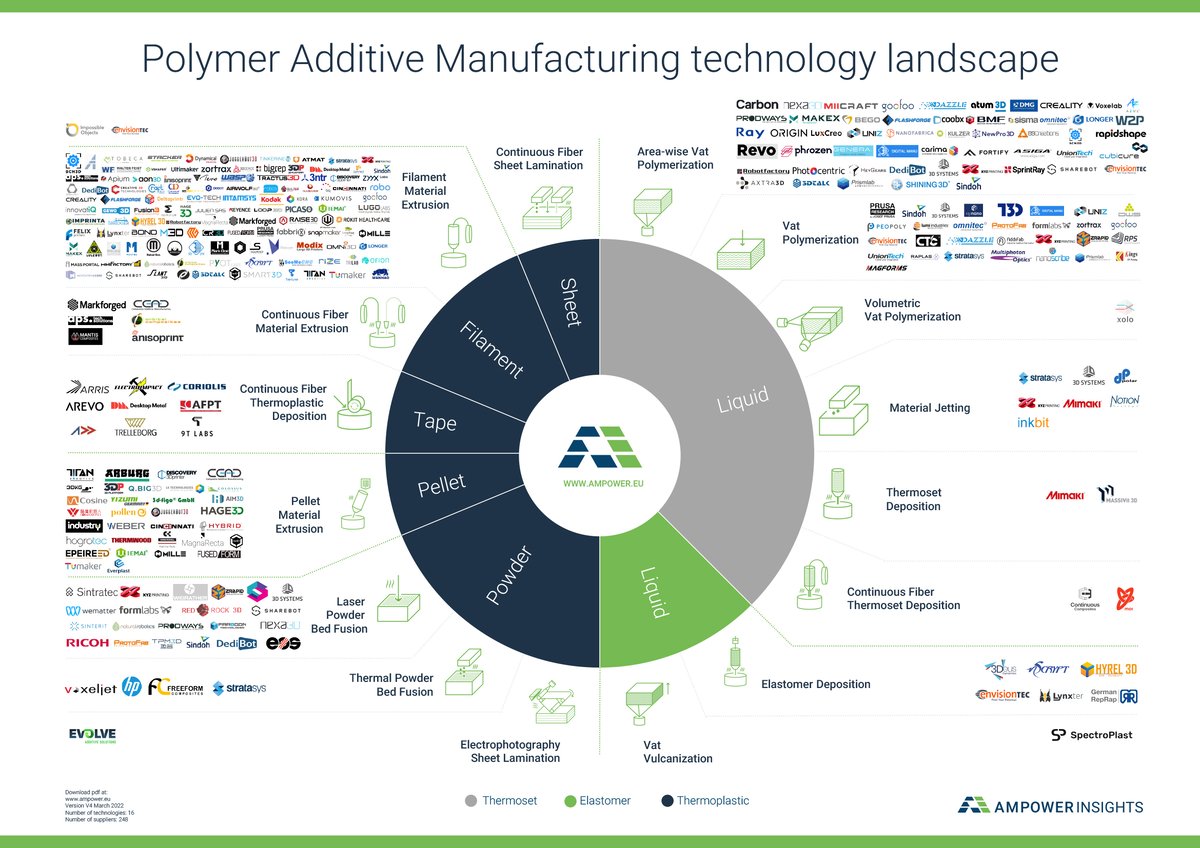

I think so. What we can really see is that market consolidation took place in the last year. There are a couple of new start-ups with exorbitant growth-rate projections, but the majority of the market is still dominated by powder bed, FDM, SLA, and makers of those conventional AM technologies, which represent the majority of the market volume, are taking a more conservative view of their future growth.

End users are also more conservative, they have more realistic growth rates projected for their own use of AM because they know what they need in the next few years. It’s no longer guess work.

Q. Is the projected growth in metal AM due to the idea that it could fix supply chain disruption?

Supply chains are a hot topic, but it’s not what’s driving growth right now. What is really making people invest in AM is scaling up production. Companies that have serial applications for AM have clear expectations of how many more machines they need because they’re seeing more use cases. For them, they’re seeing the technology established as a production technology.

The supply chain issues are always a concern, but 3D printing alone won’t solve it. Many underestimate the efforts needed for part qualification before an application can be shifted to AM. This is not what is driving the volume in the coming five years. Beyond that, however, AM definitely has potential to contribute to localized manufacturing strategies.

Q. Is powder bed fusion still the biggest technology in metal AM?

Binder jetting is going to be the metal AM segment with the strongest growth in the next five years, but coming from a level that is still significantly lower than powder bed fusion.

In powder bed fusion, we’ll see about 1,500 machines sold every year and with binder jetting we’re talking about 80 to 100 machines sold every year.

The metal filament side remains quite diverse. When we ask AM users, the pull from the market is not very strong when you talk to companies about whether or not they want to use it. But if you ask the suppliers of those machines, they still believe very strongly in this technology.

We also see a very clear split geographically when it comes to metal filament adoption. In the US, metal filament machines sell well especially to companies without previous experience in AM. In Europe, suppliers are not making much progress selling those machines.

The problem seems to be that end-users try metal filament AM, but eventually don’t see production level potential there. From an industrial standpoint, companies would rather invest in binder jetting technology to move to production metal parts. Secondly, the target applications for metal filament technologies are small series, jigs, and tools. Here, the new, very low cost powder bed fusion systems offer a proven alternative to lower cost and, more importantly, first-time-right metal part printing.

Q. Technology advancements have enabled some AM technologies to become available in smaller, more affordable machines. Is smaller the trend?

Actually, there’s a strong demand for large and very large metal AM systems. In 2021, the sales of small and medium systems, which are the 250 – 300 mm systems, made up about 75% of the total. Both suppliers and buyers forecast that this will shrink to a sales share of about 55% to 60% in the next five years.

The large and very large metal systems – larger than 600 mm – will grow stronger in this time. The industries driving this growth are space and energy.

It’s a similar move to larger systems for metal laser machines. Currently, about 50% of the metal laser systems are single lasers and the other half is dual or quad laser systems, but in the next five years we’ll see that market dominated by the quad-laser systems. It just doesn’t make sense anymore to invest in small systems. There’s very few companies buying single laser metal machines, except for some medical companies reluctant to switch to multi-laser machines because they’ve qualified their production on a single laser.

Q. What’s the forecast for polymer-based AM technologies?

What’s interesting in the polymer side is that the market is becoming more diverse in terms of technologies. You have powder bed fusion, but you also have a very strong vat segment, especially DLP systems, and the filament side is also strong – not necessarily from the revenue side rather more in terms of the numbers of machines sold.

The potential of polymer filament technologies seems to be limited as soon as we talk about production volume parts. In the next five years, this battle will be fought between powder bed (with its advantages regarding thermoplastic materials and high material properties) and liquid-based technologies (with their extremely high surface quality and potential for further productivity increase). Yet, as sustainability becomes more important for users, the liquid technologies have a major disadvantage.

Q. What were the surprises in terms of technology growth in your report?

In Europe we noticed quite a strong push in to the pellet FDM field. It’s promising because you have lower material costs and there’s a wider range of materials that are available. On the other hand, we’re seeing strong growth in the US for the vat resin technologies.

Q. Any major shifts in materials in polymer AM today?

PA12 is still the most common print material in AM if you look at it in terms of kilograms of material sold. This is followed by dental polymers. This two are the largest material markets.

With growing availability of PA6, you might think that companies would diversity, but the forecast is still strong for PA12 in the next five years. If you talk to users, they’re reluctant to adapt new materials, which is surprising because users, for years, asked for PA6, PP, TPU, and more materials for powder bed fusion. But now, it seems they are so used to using PA12 – and so many of their applications are designed for it – that they don’t intend to change any time soon.

Q. What companies appear in the report for the first time and who dropped out?

It’s very interesting that Digital Alloys is no longer in the report. They had a very unique and promising technology and it is unfortunate that it did not make it to industrialization.

In the 2022 edition of the report, we added more electron beam powder bed fusion technology companies; ProBeam and Wayland are two good examples. There’s a strong demand from the user side for more advanced electron beam technology. Arcam had a strong position for quite some time but made little progress in the past few years in further innovation jumps in the technology. Many users are craving more innovation in this area.

Another interesting company is Meltio, which grew exponentially in the wire additive manufacturing technology. They are extremely low cost – below $100,000 – and accessible. This is opening up a lot of opportunities for many SME size machine shops.

Q. Who’s buying the most AM machines.

In metal, the main consumers are energy companies, turbine companies, and medical companies, they represent the large installed base. In polymer, the install base leans more toward the on-demand service suppliers.

Most companies that use polymer 3D printed parts acquire them from a service bureau, whereas most companies that use metal parts will produce them internally.

This is reflected in the growth of polymer on-demand service companies, but it’s different with metal. The technology with metal is more complex to master and the differences in metal parts between suppliers is too strong. This has driven more companies to adopt the technology in-house, especially for parts that need to meet certification standards.

The full AMPower Report on Additive Manufacturing is expected to be available on March 16 starting at €900.

Schmidt-Lehr serves on the All3DP Editorial Advisory Board.

License: The text of "2022 Additive Manufacturing Market Report Uncovers Top Trends" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.