It’s time for the quarterly 3D Hubs trends report. For this report, the Dutch company used insights from its order database, an independent survey of 400 businesses, and a systematic review of the news and market analyst reports.

According to 3D Hubs, 750,000 parts were 3D printed last year using the company’s platform. Of these online 3D printing orders, 75% of them were from companies that have less than 100 employees.

Furthermore, it was US businesses which were drumming up the most online 3D printing demand with 45% of business coming from the States and almost 10% of that coming from California alone. Meanwhile, the UK is the biggest demander of online 3D printing in Europe accounting for 18% and a total of over 100,000 printed parts.

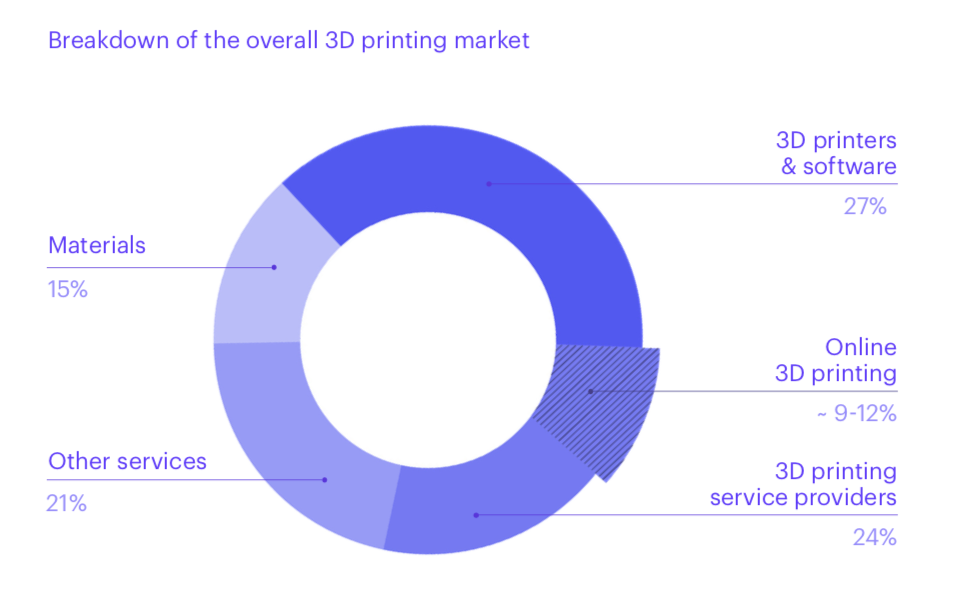

3D Hubs predict that the 3D printing market will double in size every three years. Annual growth forecasted by analysts varies between 18.2% and 27.2%. Meanwhile, investment is also rapidly growing and is focused on industrial solutions and applications.

Key Findings – 3 out of 4 Major Automotive Companies use 3D Printing

The first trend report of this year has a special on 3D printing in Automotive. This is because Automotive is leading the development of 3D printing from prototyping toward full-scale production.

In fact, the report states that 3 out of 4 major automotive companies in the US & Germany are now using 3D printing to mass-manufacture parts for their cars or for spare part production. Better yet, 75% of these major automotive companies in the US & Germany are using 3D printing for end-use parts.

Currently, the technology is predominantly used for prototyping. But, as 3D printing is “universally adopted” for this use, companies see an enormous increase in a company’s efficiency. Another use is manufacturing custom tooling which BMW, Ford, and Bosch have readily adopted.

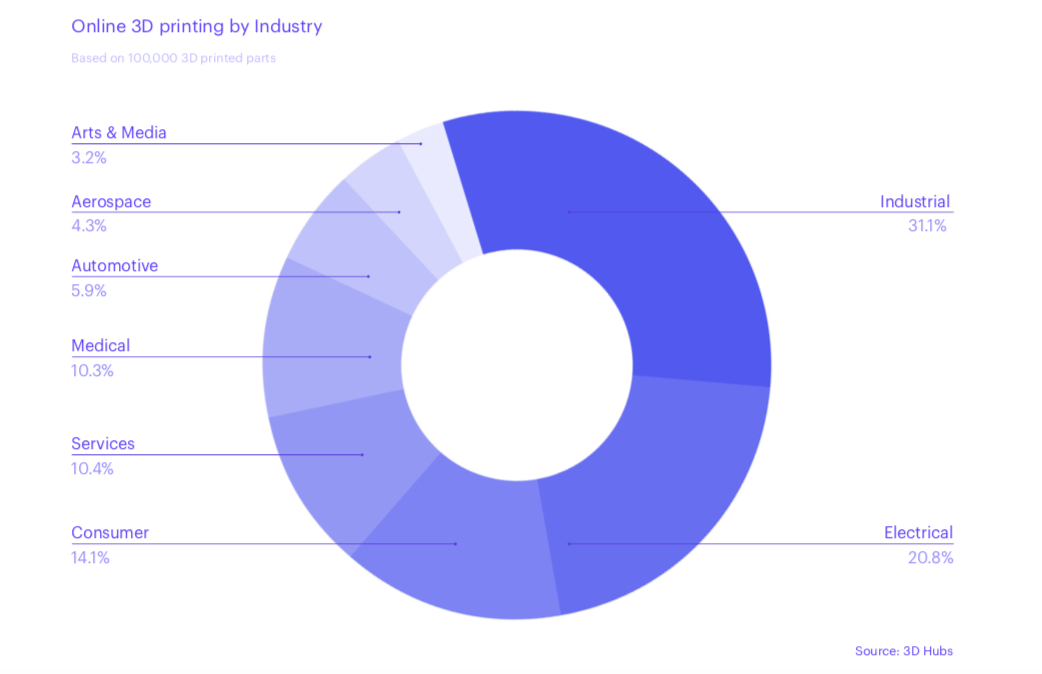

Furthermore, over 60% of global 3D printing demand predominantly comes from engineers who are working in the development of industrial, electrical and medical goods.

3D Printing in the Aerospace Industry

3D Hubs found that, although aerospace and automotive engineers do use 3D printing technology, they aren’t inclined to use online 3D printing services. Yet, they still make up 10% of the market.

In fact, the company adds that “3D printing is making steps towards manufacturing.” Thanks to the automotive and aerospace industries, engineers are working on integrating the technology into their manufacturing portfolios to increase production.

However, 3D printing will not replace technologies such as injection molding and CNC milling altogether. But, 3D Hubs explains that it will work alongside them in a “digital manufacturing ecosystem”.

This is proven in the markets as 3D printing currently represents just 0.1% of the $12.7 trillion global manufacturing market. But, this will increase as 3D printing moves from being a prototyping tool to an end-part production method.

In fact, the Industrial industry claims 31.1% of the online 3D printing demand while electrical comes in a close second with 20.8% of demand. Consumer industry follows this with 14.1% of demand. Interestingly, Arts & Media have the smallest share of demand at 3.2%.

3D Hubs concludes that: “over 65% of the demand comes from engineers working in the development of industrial, electrical or consumer goods.”

The Slow Revolution of 3D Printing in Industry

Although 3D printing is rapidly growing, it is still considered to be a “slow revolution”. Brian Garret, co-founder & CPO of 3D Hubs, said:

“Engineers want to receive the same result every time they press print. Ensuring repeatable results has been the holy grail of industrial 3D printing for many years now. However, it takes time for international organizations like ASTM and ISO to publish their technical standards. So many early innovators, like BMW and 3D Hubs, are coming up with their in-house processes to ensure quality. This will expedite the wider industrial adoption of 3D printing.“

However, by interviewing industry experts, 3D Hubs found that knowledge is a barrier which is holding people back from using 3D printing in industry.

Instead, professional users drive online 3D printing and areas which have an entrepreneurial scene and strong tech-based community have a greater concentration of demand for the technology.

Currently, the US and Europe dominate the online 3D printing demand, but Asia-Pacific is emerging. But, Google Trends shows that last year, searches around the topic of 3D Printing were as popular in Asia-Pacific as in Europe and the US in a business and industrial setting. As a result, we can predict that Asian markets will have an “emerging role” in the growth of the 3D printing industry in the near future.

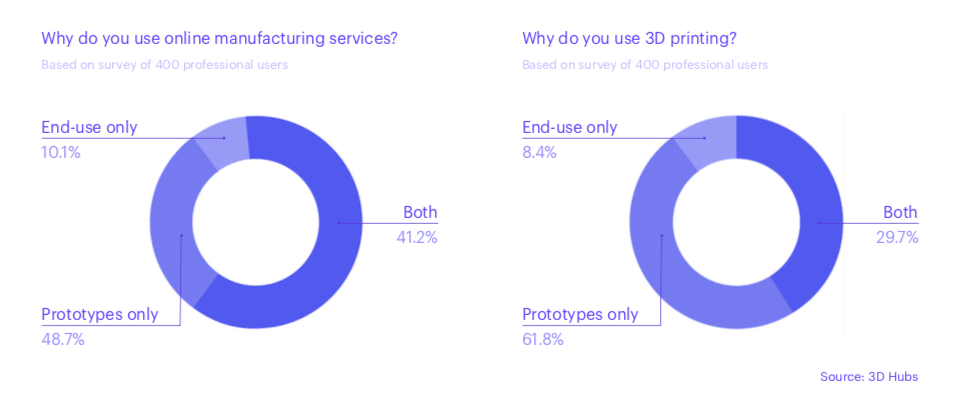

Why Engineers Turn to Other Manufacturing Technologies

Insights from a survey which 400 engineers participated in found that: “More than 50% of the respondents use online services for the production of end-use parts, but only 38% choose 3D printing for this purpose. Conversely, 3D printing is their first choice for prototyping more than 91% of the time.”

However, in industry, 90% of engineers would not consider 3D printing for productions of over 100 parts. This is because cost and lead time are critical when it comes to prototyping. Meanwhile, for production cost and material properties are the main factors and 3D printing doesn’t offer the cheapest cost per part when printing over 100 parts.

As a result, engineers turn to technologies such as injection molding, Vacuum casting, CNC machining, sheet metal and casting for metal production.

Which Materials Were Most Popular Last Year?

For 2018, the global online 3D printing demand breakdown shows that plastics held the highest demand. In fact, plastics were 100 times more popular than metals. However, metals have a value, on average, of 35 to 50 times higher.

Plastics such as FDM/FFF were the most popular and held 80% of the demand. Meanwhile, SLA/DLP and Material Jetting resins had 12% of demand and SLS and MJF just 8%.

3D Hubs adds: “For metals, the DMLS/SLM processes with aluminum or stainless steel as the material capture more than 90% of the demand.”

From September onwards, the demand for nylon drastically increased. Interestingly, 3D Hubs puts this down to the launch of HP’s MJF technology. In fact, the HP MJF printer saw a lot of action last year as it produced 10% of all online 3D printed parts in November.

3D Hubs explains: “This statistic shows both the commercial appeal of the technology with 3D printing service providers and the need from professional users for high-performance functional 3D printed parts.”

Interested in reading the entire trend report? Visit the 3D Hubs website for more information.

License: The text of "3D Hubs Releases Industry Highlights and Market Forecasts Trend Report for Q1 2019" by All3DP is licensed under a Creative Commons Attribution 4.0 International License.