Although most All3DP readers, in our professional section, are engineers, manufacturers, and industrial designers, we also reach all of the companies that make and sell professional 3D printers. So when we had to chance to sit down with Gil Lavi, a well-known marketing and sales veteran who’s held top positions at Stratasys, HP, MakerBot, Roboze, and BigRep before launching his own consultancy, we jumped at the opportunity to get his take on why certain 3D printers are growing market share, while others are not.

Today, Lavi uses his expertise to help 3D printing companies expanding their businesses globally, and he’s seen the same problem over and over again: So many innovative hardware, software, and material companies have great products, but they find it hard to know who to sell them to and how.

Start-ups spun out from universities and led by scientists focus on their invention and what it can do, more than the problem it may solve for a particular customer in a particular industry. Recently, this has been a hot topic among additive manufacturing industry insiders pointing fingers at over-marketed and under-developed AM technology as one reason for weak 3D printer sales lately and lagging adoption.

But once companies accept what no longer works, where do they go? Lavi shares his advice for 3D printer manufacturers who want to grow their business and the new focus customers are looking for.

All3DP spoke to Gil Lavi on the eve of the Rapid + TCT 2024 event in Los Angeles where nearly all of the major 3D printer brands where on hand to meet current clients and attract new customers.

All3DP: You’ve been in additive manufacturing for almost 20 years with a front row seat to the market ups and downs. Where is the market right now and how can 3D printing company best position themselves for growth?

Lavi: “Today, to get into the additive manufacturing industry, either for talents or for companies, the focus is on manufacturing. If you come up with another prototyping solution, you have to be really, really unique to compete with the other hundreds of solutions in the market, many of which have risen from the consumer 3D printer segment. You have to be the solution where investors say, ‘Yeah, this solution is going to replace traditional manufacturing; it’s fast enough, it has the right materials, quality, and repeatability.

“Yet, after what happened in the past four or five years, customers are saying, “wait, wait, wait. Not so fast”, because now it’s manufacturing not prototyping with a 20k printer. It’s a heavy 100K, 500K investment. So they are very cautious.

“For young companies developing 3D printing technology, it’s harder to attract investors because they need to be at a different point than where start-up were five or 10 years ago to get funding, they need to get into a higher level of maturity with their collusion, a higher level of convincing that this is a true manufacturing technology.”

Which 3D printing company today are attracting investments or have solid performance?

“Take a look at 3D Systems recent move to develop technology for direct 3D printing of clear aligners. They have a proven technology and approached a specific industry with a certain application to solve a problem. It’s one application, very similar to what Carbon did with the shoes [with Adidas], then you optimize the entire workflow — software, materials, technology — for that application.

“In order to be successful today, to be a manufacturing solution, you need to have a clear focus, where you want to go, what is the application, then you optimize the entire process to offer a benefit over how it’s done today, which ultimately involves lowering the cost per part for customers.”

Why do start-ups in additive manufacturing fail today?

“In the past decade, I’ve worked with dozens of startups in the industry, and in most cases, it’s the same story. A group of talented people from a university invent something. They get a little bit of angel funding to develop a certain technology into an actual prototype of a printer. In their lab, they manage to print something in a specific material at a specific scale, or a specific speed, or combination of materials. They are in love with it, but then this is where it fails.

“They think that if they take the technology from their lab and put it at the customer’s site, first, it will work properly, and second, the customer will be able to operate it. So many start-ups fail at this point. They don’t understand the gap between what they have in the lab and the level of maturity the customer needs.

“For those that do go on and develop a product that’s actually easy to use and delivers benefit, they run into challenges when they try to scale up their business, sell in other countries or to other industries.

“In order to push their technology, they need resellers, marketing, lead generation, and a small company usually doesn’t have the budget to stretch. AM is an industry that grew very rapidly over the past 10 to 15 years, and there are not a lot of people with experience marketing additive manufacturing tools. Each industry is unique. For example, if you make shoes, and design shoes, you have a roadmap that’s already been set out on who will sell your shoes, how to market your shoes, who will likely buy your shoes. But if you’re a small 3D printer maker, even many resellers aren’t sure what’s going to sell and how to market the products.”

Are resellers part of the problem when it comes to the possible “over-hype” of what professional 3D printers can do?

“Resellers in the past five to seven years were so excited about new technologies. I visited a reseller in Asia recently, and when I stepped into their showroom, I saw five different demo units and two more under blankets. I asked, ‘are you’re selling all of these brands?’ They said, “no, no, this one doesn’t work, that one, we just cannot work with them, and this one, we’re waiting for the new extruder and we’ve been waiting for three months now because it’s under development.’

“Yes, resellers were once overly excited, but now, they’re cautious from too many bad customer experiences, and working with printer makers who don’t know how to transfer their knowledge to resellers. Overall, it’s much more challenging for companies to onboard good channel partners today.”

What’s the formula for success in a start-up 3D printing company?

“If I would found a company now, I would go to specific industry and find one or two applications where additive makes sense from all the advantages of additive in terms of geometry, speed, and, critically, materials. Once you truly understand what the application is, including its standards, certifications, regulations, and then — working the other way around — I would look for a technology or invent a technology that can print it.

“Then, when you bring it to customers in industry, they say, ‘yeah, this is what we need,’ because it has the cost per part, the material, the quality, the tolerances, etc.”

Q. I’ve noticed that in the downswings of the AM industry, the first people to be let go at medium and large 3D printer makers are the communications and marketing staff, and most small 3D printer makers never had people in these positions at all. As a result, perhaps, I’ve seen more companies like yours, 3D Alliances. What do you bring to the market?

“The new program we’re launching is called the Impact Program – Revenue Accelerator for AM Companies.

“Since the vast majority of AM companies sell their solutions via sales partners, having a strong and optimized channel network, along with a clear channel management methodology, is crucial for maximizing sales performance. Without a professional and dedicated channel network, potential revenue in specific countries or regions will be missed.

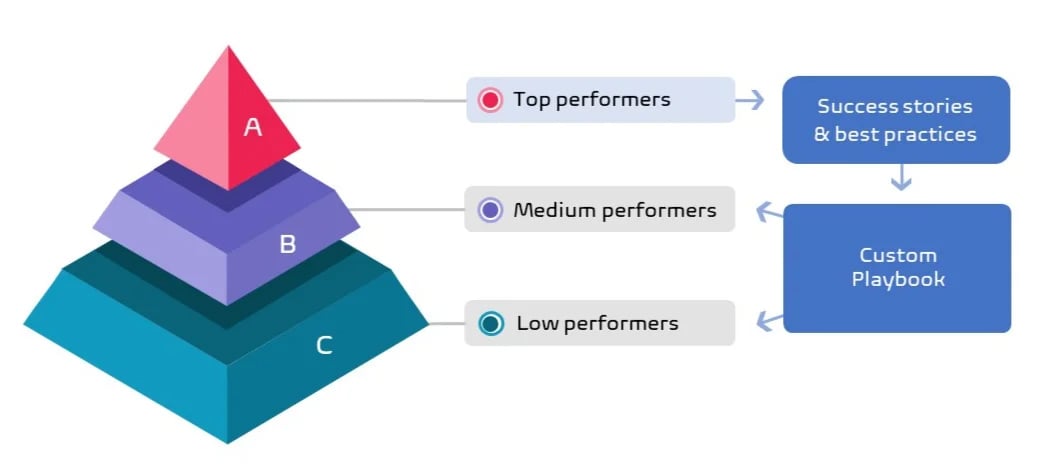

“Let’s say we have a printer company with the 20 channel networks. Usually, these channel partners are selling the same solutions, and have top performers, those that that selling okay, and those that don’t sell well at all. We analyze what makes the top performers, top performers, and there are so many reasons; high technical people, the right marketing approach, focusing on specific industries, etc. Then we write a playbook.

“For example, a Spanish company that wants to expand to Italy; we analyze how top performers are succeeding in Italy and provide you with a roadmap, because every country requires a different approach.”

(3D Alliances can either prepare a market report playbook or take over the task of gaining market share for your company themselves.)

License: The text of "AM Industry, Do You Want to Sell More 3D Printers?" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.