After attending Formnext South China in Shenzhen last year, TCT Asia 2025 in Shanghai was a great opportunity to dive deeper into the local additive manufacturing (AM) industry, explore the latest developments, and assess its growing impact on the global AM landscape. With over 450 exhibitors and 36,000 pre-registered visitors, the event showcased the latest advancements and achievements of China’s leading AM players.

During the show, I had the opportunity to engage with professionals from a variety of companies, discussing the current state of the industry and what the future holds.

The AM Growth Catalyst – “Made in China 2025” Program

One of the key drivers behind the growth of the additive manufacturing (AM) industry in recent years has been the “Made in China 2025” program. This national strategic plan, initiated by the Chinese government, aims to shift the country from being the “world’s factory”—known for producing low-cost, low-tech goods—toward becoming a global leader in high-tech, advanced manufacturing.

The program’s primary goal is to reduce reliance on foreign suppliers by fostering the development of high-tech products and services. To achieve this, several policies have been implemented, including:

- Tax incentives for high-tech companies.

- Encouraging mergers and acquisitions (M&A) of foreign technology firms.

- Increased R&D investment by major manufacturing enterprises.

Since Additive Manufacturing (AM) was identified as a key technology under this initiative, China’s AM industry has experienced rapid growth in recent years, positioning the country as a dominant player in the global AM landscape. Given China’s strong foundation in traditional metal manufacturing, Metal Additive Manufacturing (Metal AM) has received special attention, driving significant advancements in this sector.

TCT Asia 2025 – Feel the Beat

The first noticeable aspect of the event was its dynamic and energetic atmosphere—as a trade show should be. Booths were consistently packed, and the halls were bustling with activity. A diverse range of companies showcased solutions spanning 3D software, AM materials, desktop and large-scale industrial polymer and metal 3D printing systems, and service providers.

Another standout observation was the rapid expansion of Metal AM companies offering industrial solutions, with most relying on laser-based technologies. Major players such as BLT, HBD, Farsoon, UnionTech3D, ZRapid, and many others are recognizing that end-to-end solutions are essential to drive the next phase of AM adoption.

How is Additive Manufacturing Perceived in China?

In China, Additive Manufacturing (AM) is viewed as another manufacturing method, complementing traditional processes. In contrast, in the West, AM has historically been more focused on design and prototyping rather than full-scale production. This difference in mindset has led Chinese AM companies to prioritize end-to-end solutions with a clear value proposition: delivering competitive cost-per-part compared to traditional manufacturing.

From the customer’s perspective, the method of production is secondary—as long as they receive the parts they need, efficiently and cost-effectively.

The Key to Success: Accessibility & Scalability

When analyzing China’s most successful AM companies over the past five years, a common success factor emerges: making 3D printing more accessible and scalable, regardless of price point.

- Low-cost solutions such as: Bambu Lab (FDM) and HeyGears (DLP).

- Mid-to-high-end solutions such as: UnionTech3D (SLA) and Intamsys (FDM).

- Industrial high-end solutions such as: BLT and HBD (Metal AM).

Even companies like Bambu Lab, known for low-cost desktop solutions, have seen growing adoption in industrial settings. Many businesses now use Bambu Lab printers to produce end-use plastic parts because of their cost efficiency and fast turnaround for specific applications.

Who is Leading in Additive Manufacturing?

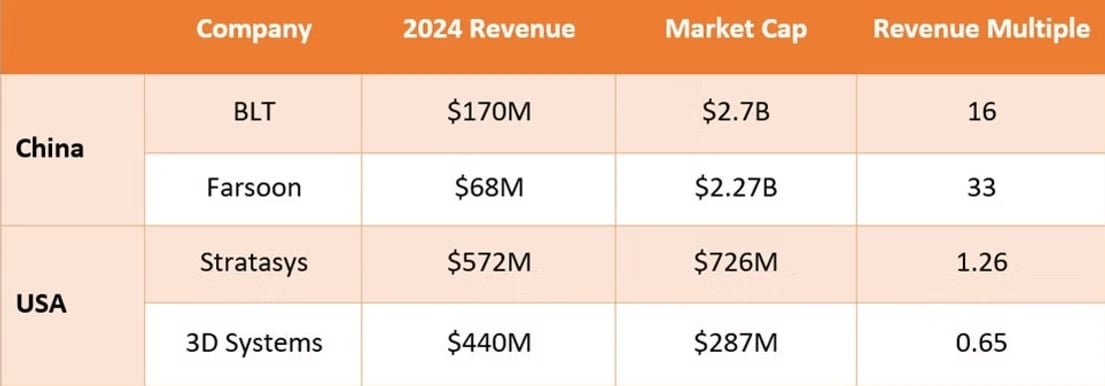

One of the most effective ways to measure the success of local AM companies compared to their Western competitors is by analyzing their financial performance and market capitalization.

When comparing China’s leading AM companies to top Western players, it’s clear that the gap has significantly widened—especially in the past few months:

- Metal vs. Polymer – Chinese leaders focus on Metal AM, while Western leaders prioritize Polymer AM. This difference aligns with China’s strong traditional metal manufacturing base and its focus on industrial applications.

- Hybrid Business Models – Chinese companies like BLT generate significant revenue from 3D printing services alongside hardware sales. This diversified approach provides more recurring revenue streams compared to Western companies that primarily sell machines and materials.

- Growth & Profitability – The real game-changer isn’t just yearly revenue, but growth rate and profitability. Investors see Chinese AM firms as having higher long-term growth potential, which fuels their market valuation advantage over legacy Western players.

The Race to the West: How Chinese AM Companies Are Expanding Globally

The rapid growth of China’s Additive Manufacturing (AM) sector has created intense local competition, driving companies to explore overseas markets to maintain profitability and scale.

After engaging with dozens of Chinese AM companies at Formnext 2024, TCT Asia 2025, and direct visits to company HQs, I’ve identified three major groups in their global expansion efforts:

- Veteran Industry Leaders: These companies have established a strong global presence over the past two decades, with subsidiaries and channel networks in Asia, Europe, and North America. Examples: UnionTech3D, Farsoon, E-Plus3D.

- Fast-Growing Challengers: Companies that have entered Western markets in the past five years, rapidly building brand recognition and market share. Examples: BLT, Bambu Lab, Intamsys.

- Emerging Players with Untapped Potential: While offering similar technologies to industry leaders, these companies face significant barriers to global success, such as: Lack of unique value proposition, limited technology maturity, weak go-to-market strategy, cultural & language challenges.

The third group consists of companies that are not set up to sell their products overseas in large volumes. They perform well in China but are less likely to achieve sustainable business growth, particularly in distant regions like EMEA and NA. Therefore, when an end-user or a reseller of AM products is looking for a new vendor, they must be aware of the disadvantages of working with a supplier whose main value proposition is attractive pricing.

One major recent milestone in this context is the distribution agreement between BLT and GoEngineer in North America. With an annual revenue of approximately $100M, of which 35%-40% comes from reselling additive solutions—mostly Stratasys—the fact that GoEngineer chose a leading Chinese vendor as its primary Metal AM solution provider suggests that challenges such as the U.S.-China trade war and the use of Chinese products by leading U.S. manufacturers are not insurmountable obstacles to the expansion of Chinese AM solutions in North America.

As China’s AM ecosystem continues evolving, the next few years will determine who successfully navigates global expansion—and who gets left behind.

What’s Next? My Humble Forecast …

We need to move beyond the perception of China as merely a ‘low-cost solution provider’ in additive manufacturing and recognize that the government’s strategic initiatives will inevitably drive local companies to develop their own groundbreaking AM technologies.

I wouldn’t be surprised if, in the coming years, Chinese companies introduce entirely new AM technologies—developed and invented in China—with a strong emphasis on manufacturing applications. Just as we’ve seen with electric vehicles (e.g., BYD), artificial intelligence (e.g., DeepSeek), and various other advanced industries, China is on a clear trajectory to lead in high-tech innovation. Additive manufacturing will be no exception.

About the author: Gil Lavi is the founder and CEO of 3D Alliances, a consulting firm specializing in additive manufacturing. In 2018, Lavi founded 3D Alliances to support innovative hardware and software additive manufacturing companies in their global business and channel expansion. The company has built a network of over 2,000 resellers across 74 countries, assisting clients like Essentium, Xact Metal, and XJet in deploying and managing their global channel networks. In addition to channel recruitment, 3D Alliances offers services such as the IMPACT Program, talent acquisition, and marketing solutions, aiming to accelerate business growth for 3D printing companies.

License: The text of "Beyond Low-Cost: China’s Bold Strategy for AM Dominance" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.