VoxelMatters Research, a market analysis company specializing in tracking the global additive manufacturing industry, dives deep into composites in its new 250-page study “Composites AM 2024.” (All3DP readers receive 10% off the report with this code: ALL3DPCOMP10, valid until June 6, 2024.)

Composites – 3D printing materials that consist of a polymer and an additive, such as carbon-fiber infused nylon – are surging in popularity on a reputation as the strongest and most durable engineering-grade polymer for professional and industrial 3D printing.

But who is really making and using these materials? Which 3D printers best optimize them, and what role are 3D printing services playing in the growth of this additive manufacturing market segment.

For example, if you’re a 3D printing service company, should you invest in composite materials and composite-ready printers? If you’re a material maker, would launching a line of composite materials pay off? If you’re a hardware manufacturer, should you ensure than your machines can optimize composite parts?

For end-users, it’s also important for your company to understand the role of composite materials, printers, and services in professional and industrial 3D printing.

With a projected market growth rate of 25.8% from 2023 to 2033, according to VoxelMatters Research, the composite AM market will experience very healthy expansion from $785 million in 2023 to $7.8 billion by 2033.

“The use of composites additive manufacturing has been expanding dramatically since companies began to discover the benefits of composite material in large format additive manufacturing,” says Davide Sher, CEO and analyst at VoxelMatters Research. “This has enabled a new wave of cost-efficient products – mainly tools used in traditional manufacturing and even in traditional composite manufacturing – where the value proposition of AM is particularly evident. But we have only begun to scratch the surface of possibilities, as new continuous fiber 3D printing and hybrid systems for direct production make their way into the market enabling additive mass production of composite parts.”

To get to its encouraging figures, VoxelMatters Research analyzed data from 741 hardware, materials, and service companies directly involved in composite additive manufacturing. These companies were identified from VoxelMatters’ proprietary database of more than 7,000 companies.

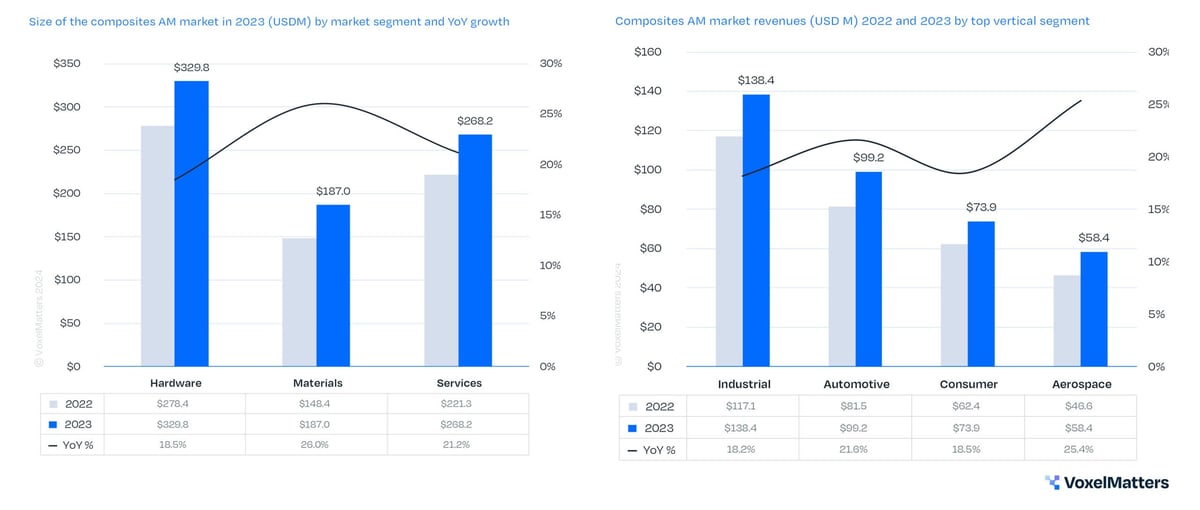

The data audit revealed the core composites AM market size in both 2022 and 2023 to be worth $648 million and $785 million respectively, indicating a growth of 21.1%. From there, the researchers mingled first-hand data from the companies, other verified analyses and forecasts, and VoxelMatters Research’s own forecast model.

VoxelMatters Research found:

The overall composite additive manufacturing market experienced growth in 2023 … across all segments. Hardware sales increased from $278 million to $330 million, showing a +18.5% YoY increase. The materials segment experienced the highest growth, going from $148 million to $187 million, a +26% increase. Services, on the other hand, increased from $221 million in 2022 to $268 million in 2023, a +21.2% YoY growth.

AM Composite Market by 2033

Looking forward 10 years, the future of composite additive manufacturing is brightest for service providers, the research found. “Services are forecasted to witness the highest growth rate, projected to grow from $268 million in 2023 to almost $3 billion by 2033, at a CAGR of 27%,” according to the report.

“Composites are expected to grow to represent an increasingly large percentage of the overall polymer 3D printing market, especially across technologies such as large format material extrusion (LFAM) and laser powder bed fusion (SLS). In these segments, composites will grow at a higher rate than neat polymers however the overall polymer AM industry will also grow driven by photopolymerization processes which are not expected to include a large percentage of fiber reinforced composite materials for the foreseeable future,” says Sher.

The hardware segment of the composites market, which is lead by companies including Markforged, Stratasys, EOS, and HP, is predicted to grow 24.4% from 2023 to 2033, while the materials segment is expected to increasing 26.5%.

The industry verticals fueling the growth of composite 3D printing is no surprise with automotive expected to grow to comprise 13.8% of the market, a $1 billion value, and Aerospace forecasted to rise to $720 million, growing its share to 9.2%.

In addition to the broad strokes of market makeup and growth, Composites AM 2024 delves deep into the nuances and complexities of the market. It explores the AM market-leading companies, the various technologies (extrusion, powder-based, etc.), types of composite materials, workflow automation at service companies, and adoption of composites for specific applications, such as functional prototypes, metal replacement, mold tooling, and robotics.

Composites AM 2024 features more than 100 charts and data tables along with its in-depth analysis of the rapidly growing composite sector. Get 10% off the $3,110 purchase price with this code: ALL3DPCOMP10. Check out VoxelMatters Research’s other market reports on technical ceramics, metals, polymers, and traditional ceramics. Save roughly €1,000 when you bundle two reports now on sale.

License: The text of "Composite Materials: Driving 3D Printing to End-Use, Mass Production Parts" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.