Industry thought leaders convening at the recent Additive Manufacturing Strategies conference New York City should have been as gloomy as the February weather, but they weren’t.

No one doubts the current business environment for additive manufacturing (AM) is not looking great right now. There’s an external perception by investors that is less than flattering, growing credibility issues, and simply bad sales numbers. AM still struggles to meet the direct needs of manufacturers and has failed to reach its obvious potential.

Given the last few years of depressed revenues, failing companies, and increased competition from Chinese machine vendors, it would have been easy for conference attendees to wallow. But most of the experts remained optimistic, even excited.

“There’s plenty of adrenaline right now,” said Arno Held, managing partner at venture capital firm AM Ventures. “But if we have learned the right things, we will be okay.”

AM by the Numbers

Yoav Zeif, CEO of Stratasys, in his keynote speech, described 2024 as “a year of great achievements but also a harsh reality to all of us. Did the world lose trust in AM? No. But it is a critical moment.”

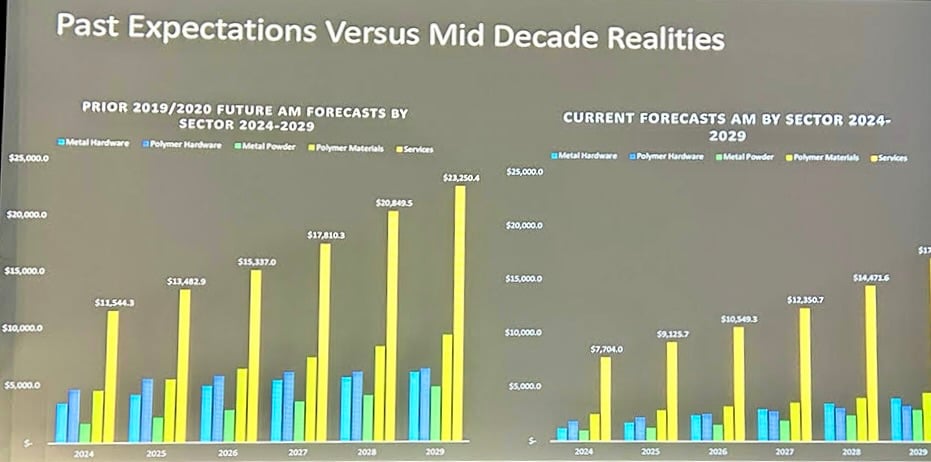

Scott Dunham, executive vice president of research at Additive Manufacturing Research, presented his mid-decade update. He noted that in 2019, predictions were for a 2024 revenue of $11.5 billion, but it was actually $8 billion, about a 20% miss. Predictions for materials and print services were about 40% higher than reality. But, the market is still growing, albeit a little more languidly than hoped, with total global market revenues in 2024 at $10 billion, which grew to $16.5 billion in 2024.

When trying to explain what went wrong, Dunham pointed out that sales were hampered by industry instability, end users are not well aligned internally for new technologies, and vendors are treating AM as new tools while end users are using them to solve problems in existing processes.

Further numbers from Yoav Zeif underscored the loss of confidence from investors as a result of the failures of the five SPACs (Special Purpose Acquisition Companies) in 2021. Namely, investors were promised $2 billion in combined revenues, but the reality was $400 million. Ten AM companies became insolvent in 2024, and $800 million in investments went with them – the companies either went bankrupt or worked through bailout deals.

No wonder the investors have been a little upset.

What’s the Solution?

Interestingly, most presenters each came to the same conclusion independently of each other: Whereas last year’s conference was bullish about consolidation being critical to the industry (it didn’t happen, although the market started rationalizing itself anyway), now the message is about developing clear and engaging applications for AM.

“We have to augment the vertical value chain or replace it,” says Joris Peels, vice president at Additive Manufacturing Research.

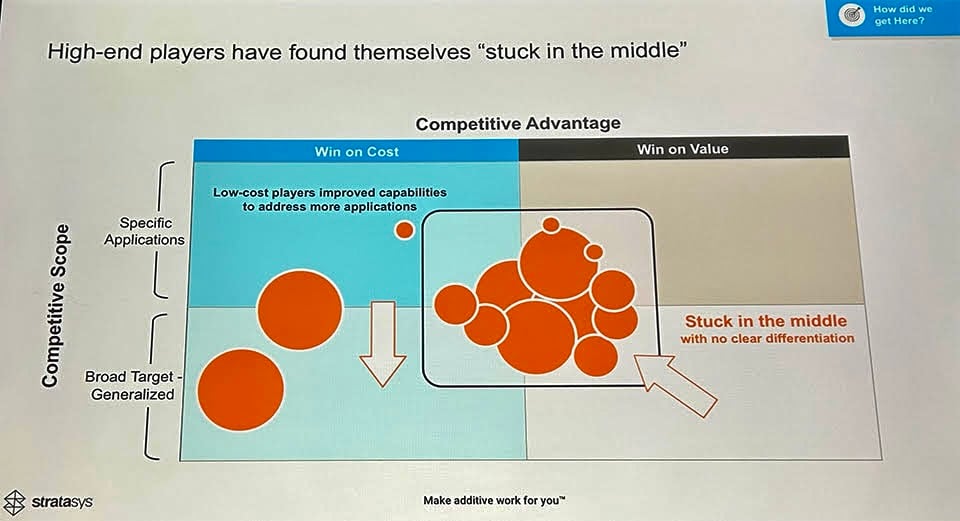

Zeif agrees, stating that AM machine vendors have clung to their general roots and are “stuck in the middle with no clear differentiation. This is not sustainable, and we are just competing with each other.”

“We have two choices – we win on value, or we win on cost,” said Zeif.

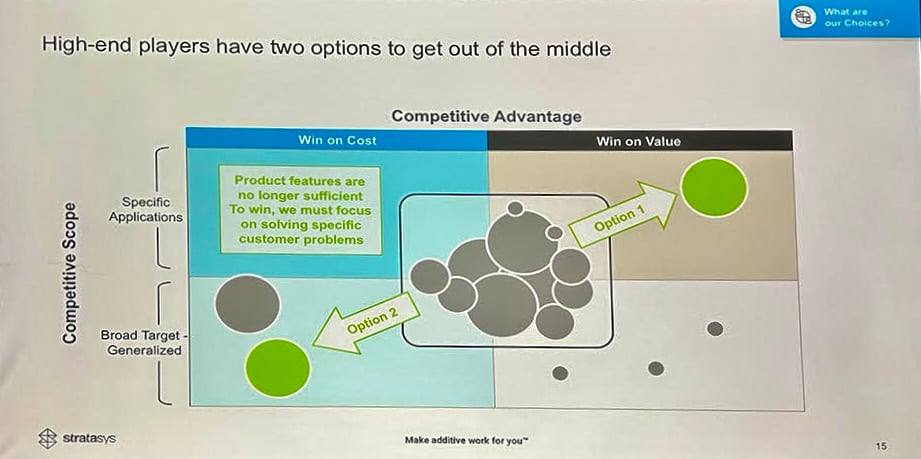

“We need specific solutions for specific applications,” says Zeif. “We need better ingredients for success, better solution products, we need differentiation and applications.”

Many of these speakers hinted that we shouldn’t be talking about AM (hence the title) in and of itself – we need to get away from the fascination about machine features – and focus instead on how it is best used.

Indeed, when All3DP spoke to Jeff Graves, CEO of 3D Systems, at the event, he shared how the company has repositioned itself to be very application-focused, with a large (and expensive) engineering applications team – and they are working to be smart to pick out the right markets to address.

Light at the End of the Tunnel?

During one of Joris Peels’ frequent introductory sessions at the 3-day event, he described the state of the AM market as “a tunnel we can now feel and touch, but we don’t yet see the light at the end of it.”

In a later panel hosted by Alex Kingsbury from nLight, in a discussion about Mergers & Acquisitions and Capital Markets, Stephen Butkow from Cantor Fitzgerald described his view of the AM market as “still has a bit of a hangover from 2024. We are not through the uncertainty yet.”

But all the panelists expressed some optimism, with Held from AM Ventures stating he felt the AM market would improve by the latter half of 2025 as long as there wasn’t yet another hype cycle in progress.

And as for the much-vaunted consolidation message from last year?

“Every CEO said consolidation was the answer last year,” said Danny Piper from NewCap Partners. “But M&A has always been moving towards generalization rather than a specialization. However, Nikon has been taking a pattern of specialization, and it’s working.”

In terms of the current switch from machine features, and industry consolidation over to a focus on applications, this is good for the industry. We should be delivering solutions that compete against traditional manufacturing methodologies and not against other AM offerings. We should be collaborating more between vendors, was the general consensus. We should be listening to the customer more closely. It is good to hear this being discussed … but didn’t we already know this?

License: The text of "Dozens of Additive Manufacturing Industry Leaders Meet to Not Talk About AM" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.