With 476 metal AM companies individually surveyed, Voxelmatters’ Metal AM Market 2025 study is one of the most in-depth breakdowns of the global AM metal market. It finds metal AM is undergoing a pivotal transformation. Still only representing a small fraction of a $12 trillion global manufacturing market, according to the study, that’s about to change.

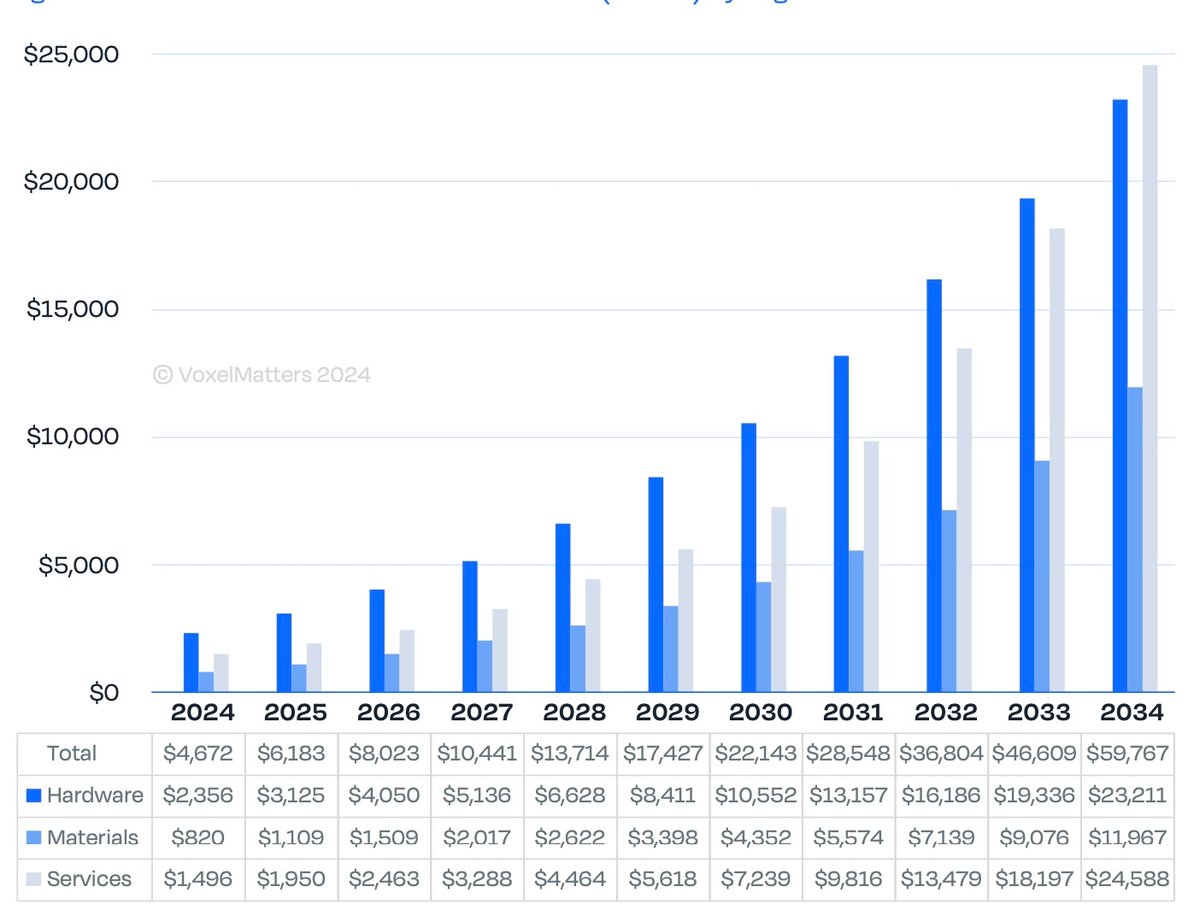

Projections for metal AM indicate a leap from $4.7 billion in 2024 to $60 billion within the next decade, with a compound annual growth rate of 29%.

There are three factors driving this growth: First, the transition from prototyping to serial and large-scale production. Second is increased adoption across the aerospace, medical, automotive, and energy industries. Lastly, advancements in hardware, materials, and services are needed.

- Industrial Parts: With $811 million in revenue, it’s the largest sector 2024. It is expected to reach $9.8 billion by 2034.

- Aerospace: This sector grew by 25% to $646 million in 2024 and is projected to hit $8.8 billion by 2034.

- Medical: With $519 million in 2024, it is forecasted to reach $6.5 billion by 2034.

- Automotive: The fastest-growing segment in the Metal AM sector ($443 million in 2024) is expected to hit $6.2 billion by 2034.

- Energy: As of 2024, it reached $422 million, projected to reach $5.4 billion by 2034.

We talked to Davide Sher, co-founder of Voxelmatters and the report’s senior analyst, about the most interesting findings.

What were the results you expected – and which didn’t you?

Davide Sher: We expected the continued dominance of laser powder bed fusion despite the technology’s many limitations in terms of part production. We also expected to see the rising importance of directed energy deposition, especially wire arc additive manufacturing processes, and, more generally, a much higher demand for large 3D printed parts for all technologies.

The most unexpected result is that the industry continues to grow despite negative hype. EMEA will remain the largest AM regional market in the world for the foreseeable future. At the same time, no matter how much research we did on Chinese companies and how much verified new data we input into our model, the APAC market remains smaller than Western markets in our 10-year projections.

With a projected growth to $60 billion by 2034 at a 29% CAGR, why is the market, in your opinion, currently so drastically underrated?

I don’t really think the market is underrated. Some companies struggle due to inefficient business models or inadequate technologies. However, several key companies in metal AM are doing well. I’m thinking in particular about EOS and Nikon SLM Solutions, with Nikon investing significantly in developing the market. But also doing well are many direct energy deposition companies, like DMG Mori and Trumpf, and also multiple smaller ones, like the big five Chinese companies BLT, Farsoon, Eplus, HBD, and Kings3D. Others like 3D Systems, GE, and HP may not grow as fast as expected, but they can overcome any challenge.

Misunderstanding and underrating come from the fact that, unfortunately, most of the AM companies went public without a solid business model. In contrast, most of the growing and healthy companies are private businesses. At $60 billion yearly, including materials, hardware, and services revenues globally, this will still be a relatively small industry as far as global manufacturing goes.

What are the key factors for metal services to grow in the next 10 years?

That’s a difficult question, as there are different factors at different times.

In general, service providers will be driven by the increase in end-user adoption. As these end-users progressively increase their use of AM for part development and internal production processes, they will, at the same time, increasingly turn to external service providers for all production overflow and large batch AM production.

In this case, service providers need to do two things: first, they need to develop complete and efficient end-to-end production workflows to cater to this demand. At the same time, they need to specialize and develop advanced and unique know-how in one or two (three at most) market segments. This should be done progressively, without overinvesting, over a decade. Those who over-invested expecting an “AM revolution” to occur within a couple of years are the ones who are struggling the most today.

Another advantage for service providers, mainly as they increasingly specialize in end-use part production and specific segments, is the ability to coordinate and integrate their digital services within digital “aggregators” that can leverage increasingly advanced AI systems to optimize the AM service offering. In general, however, we already see some of the most specialized and capable service providers in fields such as energy or aerospace continuously expanding their machine park to meet demand.

When it comes to growth in the metal AM market, what’s your sense of that coming from companies replacing traditional metal manufacturing methods with AM instead of companies adding metal AM alongside conventional methods?

It depends on the specific production segments. The AM workflow could entirely replace traditional workflows in aerospace and defense, medical and dental implants, energy, and consumer products such as eyewear and jewelry. Please note that the AM workflow is not just 3D printers but a 3D printing-centric workflow, where subtractive, robotic, and even formative systems revolve around AM part production. In other segments, such as automotive or appliances and most consumer products, AM will continue to be an additional process used mainly for tooling in traditional manufacturing processes.

When you talk about the growing challenge to the current metal AM leaders, like EOS, coming from Chinese companies like Farsoon and others, what form does that challenge take: price, innovation, market penetration?

There are several challenges. One is that Chinese companies tend to execute their strategy very rapidly and effectively without spending much time questioning it. That can be an advantage in AM, especially as their domestic market is developing rapidly and can leverage a centralized government support strategy. At the same time, once the physiological limit in receptivity of the Chinese market (as in any market) is reached – and we are now near that point – these companies will be increasingly pushing their business outwards toward Western markets, offering competitive pricing and increasingly valid technologies. On the other hand, Western companies – because they do question their strategy – continue to innovate more (in terms of developing radically new approaches to metal AM) and are retaining that advantage.

Will efforts to limit technology export for national security reasons, for example, in the US, dampen adoption or innovation in metal AM? If not, why not?

I don’t see that happening any more than it was already happening. I don’t think strategic technologies could easily be exported and imported under any administration. It may be more “outspoken” today, but I don’t believe much has changed. For sure, AM plays right into the idea of “reshoring” production everywhere, but I also think that is mostly an idea rather than an actual practice.

Lead image source: Source: Voxelmatters

License: The text of "Growth and Challenges: The Next Decade of Metal Additive Manufacturing" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.