From its 400-page market survey and analysis of the additive manufacturing industry of 2022, consulting company and industry thought leader Ampower has some insights into what we can expect in 2023 in terms of trends, printers, technologies, and materials that are most in demand.

The annual Ampower Report on Additive Manufacturing shows a couple of anomalies compared to years past and some encouraging new trends. Sales growth for professional and industrial 3D printers is strong, led by demand in the medical industry and a robust metal laser powder bed fusion marketplace. In fact, additive manufacturing market revenue will top $20 billion by 2027.

All3DP sat down with Matthias Schmidt-Lehr, CEO of Ampower, the company that publishes the annual report, to talk about the most notable findings. The Ampower Report is independent, not funded or sponsored by manufacturers, and is a comprehensive view of not only the printers and technologies that manufacturers are producing but also what end users are buying today and what they say they want and need in the future.

The data is based on hundreds of personal interviews with system suppliers, material suppliers, service bureaus, and users of additive manufacturing, covering all AM technologies in metal and polymers. The system suppliers that contributed represent over 90% of the worldwide installed base of additive manufacturing machines.

Q. The pandemic and the economic downturn continued to hamper 3D printer company sales in 2022. What effect did it have, and who faired the best?

2022 was much kinder to some 3D printer companies than others. Typically, nearly all companies in additive manufacturing rise and fall with the market dynamics, but in 2022 – where it took some agile company management to weather the pandemic and the rocky economy – some CEOs made better choices than others. Renishaw , for example, reduced staff, restructured and refocused their product line to have a successful 2022. We saw restructuring also at Nexa3D and Desktop Metal.

We’re seeing a separation now between the companies that went through a strategic restructuring during the pandemic and those that didn’t. One of the companies with the highest growth rate in 2022 was SLM Solutions [a manufacturer of metal laser powder bed fusion 3D printers].

One example of successful restructuring was the companies that shifted from being generalists — offering machines applicable to multiple verticals — to being specialists and focusing on serving the industry niche where they have the strongest adoption, such as aerospace, medical, or consumer products. The report shows that companies in the crowded metal laser powder bed fusion market have begun to specialize more.

Q. The additive manufacturing industry grew still during the global pandemic. Will that growth continue?

Yes, to summarize the numbers, the growth in polymer [3D printer sales] was around 11%; in metals, it was around 20%, so almost double polymer. The market is in an overall growth range between 10% and 20%, rather than 30%, which had been predicted before the pandemic. The forecast for polymer growth in 2023 and beyond is also a bit more positive at almost 13%. Suppliers say they’re expecting a 20% of growth in machine sales, while the users say only around 10%.

In metals, we are back to around 26% growth for the next five years, which is realistic, and that projection is also very similar among suppliers and users.

Metal Additive Manufacturing Grew by 20% in 2022

Q. Laser powder bed fusion vs. binder jet. Which is the most popular and why?

Laser powder bed fusion is still the strongest share of the sales and nearly 17,000-unit install base, and it’s an increasingly crowded market. More than 1,500 metal LPBF machines are sold every year compared to about 100 – 200 metal binder jetting units.

Binder jetting, however, especially printers from Desktop Metal, are selling quite well and they are the overall leader in the metal binder jetting market when it comes to the number of machines on the market installed. The new Metal Jet machine from HP and the anticipated machine from GE will affect the market in the next few years. More companies are looking into binder jetting, and we should see further development in this sector. Consumers, we spoke to agree that metal binder jetting printer sales should triple or even grow to six times today’s level in the next five years.

The projection growth of binder jetting is directly tied to its production capacity and consumers’ interest in end-use parts, even if the share of end-parts being produced today with binder jetting is still a tiny fraction overall. Binder jetting is primarily used for R&D and part/process qualification. As companies mature with the technology, they then will become more interested in machines for production additive manufacturing.

Binder jetting, however, is not in direct competition with metal LPBF because the applications are different. Companies will turn to binder jetting to replace complex machining, metal injection molding, press sintering, or similar technologies.

• Metal systems sales are approaching 2,250 units per year, spanning all technologies.

Q. Metal part production using metal filament is far more accessible today. Is there increased adoption?

Actually, when it comes to metal FDM systems, we’ve found that companies struggle to find use cases for it. The only use cases we see are in metal tools, where you need them very fast, in materials like H13 or tool steel. Initially, these systems were marketed as a cheaper entry point to metal but now some laser powder bed systems are lower priced.

The cheapest way to get metal parts is to buy metal filament from companies like BASF that can be printed on nearly any FDM printer. This is a completely different market because it offers the value proposition of turning your polymer printer into a metal printer with with little to no investment, and that’s attractive to basically everyone who owns an FDM printer and has access to a sintering service.

Q. Metal printing near-net shapes quickly; are we finally seeing growth in DED and WAAM technology for this?

Definitely. The interesting value proposition here is the ability to print actual end-use, near-net-shape parts and leave certain areas as printed and accept them, which saves a tremendous amount of time and material. We’re seeing an increase in application in the oil and gas sector and blanks for manufacturing. Norsk Titanium, for example, has been working on aerospace applications for years to replace instances where companies machine a part out of a huge block of metal. It’s a very interesting value proposition for conservative industries like aerospace because you can accelerate the manufacturing process while saving on expensive materials like titanium and nickel because you’re reducing the volume of feedstock, you reduce the scrap rate, and you reduce the overall cost of the product.

DED was never a hyped technology and that turned out to be somewhat healthy for this sector.

Q. What market segments have a new or higher demand for metal 3D printing solutions?

Defense is historically a very strong sector in the US but the war in Ukraine is driving more growth, and the military in general, is being strengthened in Europe. Couple this demand with the fact that, because of the war, materials, especially titanium and nickel, became more expensive last year for a short period, and the result is an opportunity for metal 3D printing. The price of metals triggered the awareness within aerospace and energy companies to curb their dependency on metal alloys and scraps coming from Russia and other overseas suppliers.

• Who’s buying metal systems? Top sectors: space, part manufacturing suppliers, industrial, medical.

Polymer Additive Manufacturing Grew by 11.5% in 2022

Q. What was the most significant news or change in polymer AM in 2022?

Many users we talked to who are looking at industrial FDM applications are looking into pellet materials. Even though it’s still just 2% of the printer market, it’s growing at a stronger rate than filament and will grow to 5% in the next five years. The reason is that it’s a cheaper feedstock, there’s more material variation, and there are more supplier options.

On the printer manufacturer side, we see a shift toward developing more high-temperature FDM machines. Everyone who is trying to grab more market share in industrial FDM printing is pursuing high-temperature applications because everything else you can do with cheap alternatives.

• 29,603 units of industrial polymer systems were sold globally in 2022.

Q. Which polymer technology has the largest share of the AM market in 2022?

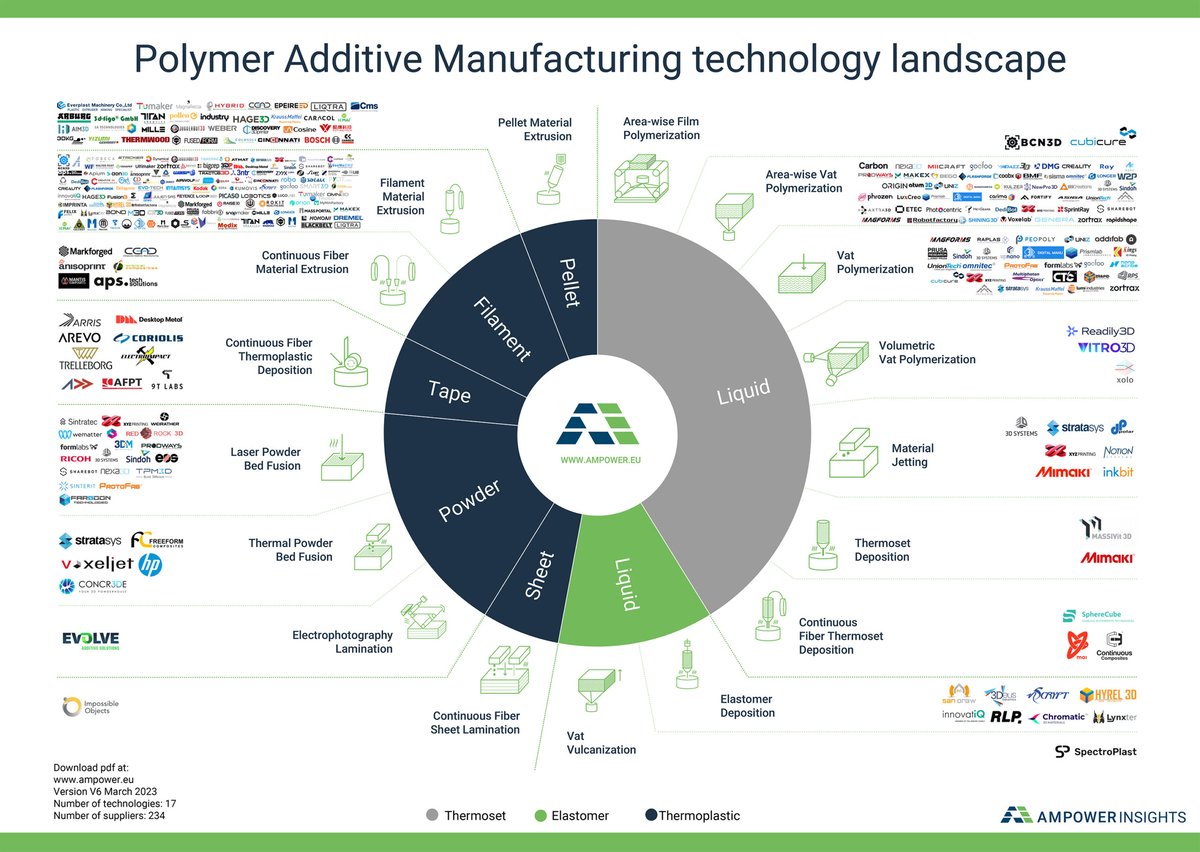

Liquid resin technologies as a group — SLA, DLP, area-wise, etc. — have the largest market share in the polymer landscape, followed by powder bed technology.

Q. Who’s buying polymer 3D printers?

Medical and dental companies are still the top purchasers of polymer 3D printers, followed by industrial, automotive, and consumer goods companies. After that we have the service bureaus.

• Who’s buying polymer systems? Top sectors: aviation, automotive, energy, dental.

The full Ampower Report on Additive Manufacturing is expected to be available on March 20 starting at €950.

Schmidt-Lehr serves on the All3DP Editorial Advisory Board.

License: The text of "Who’s Buying Professional 3D Printers & For What? 2023 Market Report" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.