This week’s $150 million cash infusion into leading 3D printer manufacturer Formlabs is just the latest eye-popping figure in the rush to back disruptive, innovative, and proven 3D printing technology companies. In fact, investors have poured hundreds of million into 3D printing companies so far in 2021.

Formlabs, the 10-year-old maker of 3D printers for hobbyists and businesses, said on Wednesday it had doubled its valuation to $2 billion, following the multi-million dollar funding round led by SoftBank Group’s Vision Fund 2.

Formlabs says it’s “on a mission to expand access to digital fabrication, so anyone can make anything,” which clearly sounds like a boundless investment opportunity to backers. But in fact, parts made on Formlabs printers can be found in the operating room, dentist chair, your car, and your shoes, with leading companies like Google, Mayo Clinic, and New Balance trusting Formlabs printers to develop, prototype and manufacture end-use consumer goods at scale.

“We believe the 3D printing industry is currently standing at the precipice of unprecedented growth and is transforming the way products are made,” said Deep Nishar, senior managing partner at SoftBank Investment Advisers.

Will This Be Another 2013?

Nearly 10 years ago, when many 3D printing companies first set-up shop and many went public, the technology was set to be the next big thing. Every house and factory in America would have a 3D printer. That, of course, didn’t happen and investors in the segment soured. So, how is now different?

One difference may be investment in relatively well-established companies (with some notable exceptions, such as Desktop Metal). Formlabs has sold tens of thousands of machines, has a solid and growing customer base, and a strong reputation for quality and service.

“Where others have promised printers capable of mass production and end-use quality parts, Formlabs has delivered,” said Max Lobovsky, CEO and co-founder of Formlabs.

Soon to go public, metal 3D printer manufacturer Markforged, also has its products in nearly 10,000 facilities across 70 countries, and generated revenue of approximately $70 million in 2020.

Other differences in the current additive manufacturing environment compared to a decade ago include more advanced technology, lower costs, and 3D printing’s clear relevance as a fix to supply chain problems exacerbated by the pandemic.

“Fans [of 3D printing] are betting that the pandemic has forced companies to reconsider how they manufacture goods longer term, with some looking more toward onshore production to prevent supply issues and shortages,” reports Laura Forman for the Wall Street Journal.

Investors’ Most Loved

Formlabs is not alone in attracting millions in investment backing. Nexa3D announced this month that it closed financing rounds exceeding $55 million in funding. The rounds were led by a multi-billion-dollar alternative asset manager and existing investors, OurCrowd and Saudi Aramco Energy Ventures, with participation from new investors as well.

While the big bucks may be going to the established players, new start-ups, many of which have not yet commercialized their product, are also attracting their fair share of backers with deep pockets because they offer solutions to known hurdles in the market.

Belgian startup ValCUN raised €1.5 million in March to further its development of a metal 3D printing technology that it says will be ecological, affordable, and competitive. They have patents on technology that uses safe-to-handle feedstock material instead of metal powders and operates without high-power lasers, which solves two of the issues keeping printer prices high and holding metal 3D printing back from mass adoption.

In December 2020, California’s PrinterPrezz secured $16 million in a Series A financing round, with which it plans to expand its efforts to 3D print medical devices and implants. A key backer of the financing round, specialty chemical company Solvay, will also partner with the startup to aid in the increased adoption of these medical products. PrinterPrezz is touted as a trailblazer in combining polymer and metal 3D printing with nanotechnologies and surgical expertise to design and manufacture next-generation medical devices and implants, a rapidly growing market.

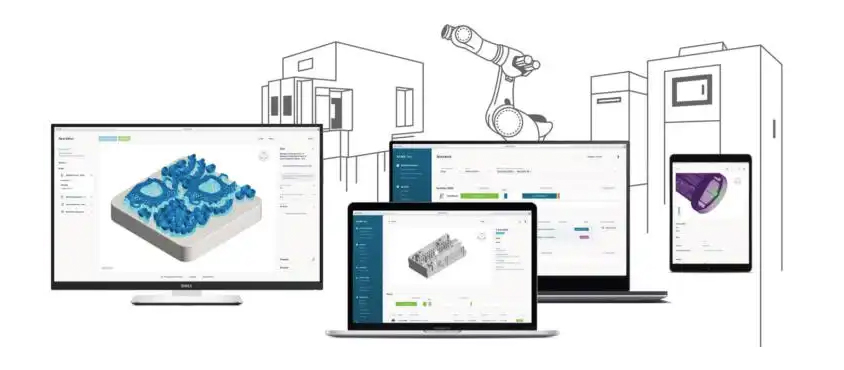

On the software side of the additive manufacturing industry, Oqton is a U.S.- and Belgium-based start-up that offers an end-to-end solution to automate additive manufacturing. The company raised over $40 million in a Series A financing round earlier this year, led by Fortino Capital, a leading B2B software investor, by PMV, the regional Flemish investment fund, and by Sandvik, a global engineering group. In particular, Sandvik—which manufactures AM powders and provides metal AM services— also acquired a minority stake in the company. Additive manufacturing can not become true production manufacturing until it solves its manufacturing execution systems (MES) software problem. Currently, a lot of additive manufacturing operates outside of manufacturers’ other processes as few systems are able to integrate it all.

Also hoping to be the solution to AM’s software problem, 3YourMind, a US-German software company in additive manufacturing, closed a Series A+ financing round last month with two prominent European investors.

Last August, US-based Azul 3D, which is still in the process of developing its high area rapid printing (HARP) technology, raised $12.5 million in seed financing to bring its line of commercial 3D printers to market. HARP technology promises to offer the largest and fastest method of 3D printing with liquid resin.

3D Printing Disrupting Other Markets

Companies gaining new cash infusions are not just solving problems within the 3D printing industry, but also addressing wider issues. Take for example, the $29 million investment earlier this year into animal-free meat startup Redefine Meat. The company offers a proprietary 3D printing technology it calls meat digital modeling, and advanced food formulations to produce animal-free meat with the appearance, texture, and flavor of whole muscle meat steaks. The Israel-based startup, expects to sell its proprietary system and plant-based “inks” to meat distributors worldwide.

Also expected to cash-in on the the global plant-based meat market, which is expected to reach $9.43 billion by 2026, is Revo Foods, a developer of 3D printing technology designed to replicate seafood. The Austrian company announced last month that it completed its first funding round of more than $1.8 million to boost its technology development and accelerate market entry.

Hoping to solve the issue of expensive orthodonture, LightForce Orthodontics, which developed the world’s first customizable 3D printed bracket system for braces, raised $14 million in a Series B financing round in September. The investment round will enable the company to further develop its 3D printing orthodontic solution and scale its business to meet the growing demand for efficient dental technologies. One of the key benefits of LightForce’s product offering is that it reduces doctor visits because the custom brackets require fewer adjustment sessions.

Watch this space for more financing news as 3D printing continues its breakneck pace into the mainstream.

License: The text of "Why Are Investors Pumping Millions into 3D Printing Companies?" by All3DP Pro is licensed under a Creative Commons Attribution 4.0 International License.