If you’re into 3D printing, Rachel Park doesn’t need an introduction. As a journalist, she covered the 3D printing and additive manufacturing sector since 1996. She led 3D Printing Industry as Editor in Chief and also edited Disruptive Magazine for 3D Printshow. Currently, Rachel works as an independent freelance journalist and runs her own copywriting and editing company.

There is a tendency, natural to a certain degree, but misguided also, to directly compare 3D printing with 2D printing! I believe that there is an intersection between the two, courtesy of the former being a subset of the latter, and, more recently, as a result of the increasing number of traditional 2D companies entering the realm of the third dimension.

For most people, the term “2D printing” conjures the image of printing typeface or images onto a flat medium, usually paper, in the form of our desktop printers attached to our computers. The traditional process works, obviously, in two dimensions — the X and Y axes. However, for anyone focused predominantly on 3D printing, it can be easy to miss the monumental developments with 2D printing. In fact, as I have watched — and researched into — this wider realm over the past 18 months, it seems to me that 2D printing can be somewhat of a misnomer as a classification for traditional printing technologies. With the advances that are being made in digital tech, imaging and wide format printers (some the size of a small house) for industrial applications, the term “2D printing” does not do the industry justice. Thus, one parallel that can sensibly be drawn here is the dichotomy between the consumer end of the market and the industrial end.

“Guestimated” Figure: 1 Trillion Dollars in the 2D Printing Industry

In terms of size, as measured by revenues, it depends where you look for (“guestimated”?) figures, but the general consensus is that the annual revenues of the global printing industry is now approaching 1 trillion dollars. By comparison, the 3D printing industry, which similarly suffers from the “guestimate” problem, is still in single digit billions. I believe this is a useful over-arching context and illustrates how the 3D printing industry can be considered a small sub-sector of its behemoth parent. Small, but significant. So significant that during the last 12-18 months, key players in the global industrial printing sector — the so-called 2D printing companies — have gone on the record with stated intentions to develop and release 3D printing technology.

They can’t afford not to get involved. While the realization of the full potential of 3D printing still has a way to go, it continues to mature and promises phenomenal growth across many vertical market sectors. So even while analogue and digital industrial print technologies are predicted to continue strong growth over the next decade, the growth curve is also predicted to flatten out; but with 3D printing the potential for steep growth over the next few decades is vast. And these traditional print companies can — and should — have a significant stake in it.

HP, Canon, Ricoh, Kodak, Epson, Xerox: Everyone’s Working On A 3D Printer

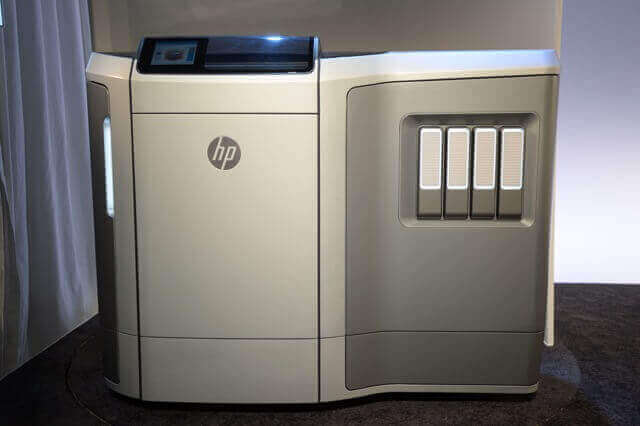

The biggest splash to date was by HP — towards the end of 2014 the company drew a line in the sand when, to great fanfare, it announced its Multi Jet Fusion industrial 3D printing process. Even despite some considerable corporate upheaval since then, MJF is reportedly still on target for commercial release at the end of this year and HP continues to make appearances at notable events to promote its 3D printing debut. There is some speculation that the first sighting of a working machine may be at Drupa in Germany, early in June.

Towards the end of last year, Canon, with much less fuss (and even fewer details) revealed it has R&D underway at its HQ in Japan for its own 3D printer. When I spoke with Canon people while at their European Expo edition in Paris, they were extremely reticent when it came to process and material details, but adamant that the most significant take-away from this announcement was that Canon IS taking 3D printing very seriously. In the meantime (there is no indication of when Canon’s 3D printer will come to market) the company is collaborating internationally with one of the 3D printing industry’s leaders — 3D Systems — in terms of distribution of the ProJet platform range. This relationship has also cultivated speculation, mainly mine, that this may lead to something more permanent between the two companies. Speculation that when posed to sources at both companies was not shot down in flames — one even chuckled and said “stranger things have happened.”

Q4 of 2015 also saw Ricoh introduce a new industrial grade machine, utilizing the laser sintering process. Unlike its competitors, the platform is available immediately. The RICOH AM S5500P works with polymers, not metal, specifically durable Polyamide and Polypropylene materials. This proprietary platform launch, intended for industrial applications followed a 13 month foray by Ricoh into what it calls its “3D Printing Related Business” in marketing materials, while the division itself, launched in September of 2014, is called the Additive Manufacturing Business, which saw the company selling third party 3D printers while also providing a range of production and consulting services for industrial partners. Ricoh worked in collaboration with Aspect, Inc. to develop the RICOH AM S5500P and states it plans to continue this relationship to further develop more proprietary materials and enhanced functionality.

Interestingly, Ricoh defines itself as a “global technology company specializing in office imaging equipment, production print solutions, document management systems and IT services.” Canon meanwhile defines itself as a global imaging company. HP – both Inc and Enterprise — is harder to define since the split into two corporate divisions, but global tech and enterprise seem to be the repeated refrains. Regardless, these three companies are certainly the most serious in terms of activity, but others are making noises about 3D printing.

Since the beginning of 2014 Epson has periodically expressed interest and alluded to R&D into industrial 3D printing. Similarly Xerox, who also had a long-standing relationship with 3D Systems and sold off a business unit to the 3D printing company at the end of 2013. Since then, Xerox has been known to file patents around a new 3D printing process, but visibility on this is hazy at best.

There is also Kodak, but as I mentioned in my CES post here, the effort put into the desktop platform it developed and released in Vegas really does feel like a bit of a token gesture. It also goes completely against the efforts of Kodak’s peers who are all focused on industrial 3D printing, with little, if any, acknowledgement of the consumer/prosumer market.

The Most Interesting Point is Based on Inkjet Technologies

One specific development within the intersection of the industrial printing and 3D printing industries that highlights the synergies between the two, and possibly points to the future is the “elevated printing” technique developed by Canon. Since Canon acquired OCE just over five years ago, the industrial printing developments from the company have accelerated. Canon’s elevated printing techniques combines its wide format industrial printing expertise with some 3D R&D. The striking result is an adapted wide format industrial printer, printing up to 1.5 cm in the Z axis to produce the elevated printing effect. While 3D printing is generally all about the Z axis, what elevated printing has achieved is limited printing in the Z axis but on an XY print bed greater than anything that has ever been seen before. Extend the Z axis further and the potential is massive — in both senses of the word.

More generally though, I believe the most interesting point of the intersection is based on inkjet technologies. The traditional industrial printing companies have invested billions in inkjet R&D, and while it is not a simple leap from 2 to 3 dimensions in this regard, it is not a chasm that cannot be bridged. There are currently two 3D printing processes that utilize inkjet techniques — binder jetting and material jetting. The former is a powder based process where the material being jetted is a binder, and is selectively sprayed into the powder bed to fuse it a layer at a time. The latter process — material jetting — employs inkjet heads that jet the actual build materials and it is here that the intersection with traditional industrial printing has the most potential in the years to come.

License: The text of "Will 2D Printing Giants Succeed in 3D Printing Business?" by All3DP is licensed under a Creative Commons Attribution 4.0 International License.