Who should read this: Anyone who wants to invest in 3D printing stock.

Before 3D printing really becomes fully mass market and 3D printers make it into every home, fulfilling the dream of fully distributed manufacturing, the ability to get products produced on demand passes through the professional 3D printing services. While these have existed at an industrial level for almost two decades, the difference is that a family of new companies have emerged over the past decade offering these on-demand, personalized manufacturing services to consumers and prosumers, through a B2C (business to consumer) model.

Led by Dutch-American Shapeways, these companies are beginning to change the world of industrial production by setting up professional level additive manufacturing factories and taking production back to the cities. They are thus beginning the process of decentralizing manufacturing and, after the 3D printer manufacturers, they are the first companies that have or might soon become publicly traded companies to invest in

Shape it my way

Shapeways is the largest and best known among the B2C 3D printing services. It was founded in 2007 as a spin-out of the Lifestyle Incubator of Royal Philips Electronics and it now has two main factories in Eindhoven (Netherlands) and Long Island City (New York City). Over the years ti was reported to have raised as much as $30 million in funding with investors that include Lux Capital, Union Square Ventures and Andreessen Horowitz in New York and Index Ventures in London.

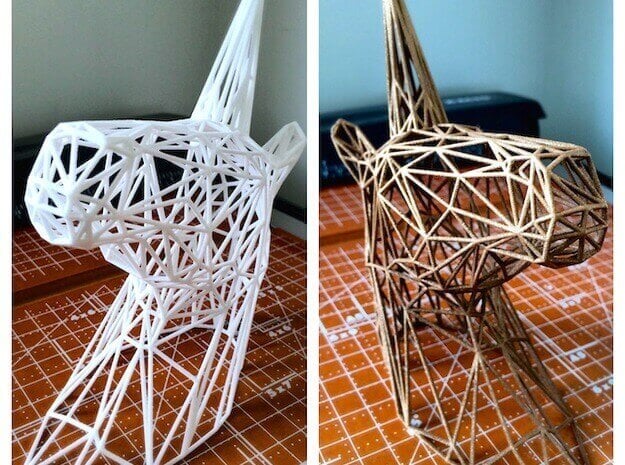

While it is unclear whether its business model is fully sustainable, the company has been growing. In 2012 it announced it has sold and shipped over one million 3D printed products and in 2014 it moved its European operations to a new, ultra-modern factory in Eindhoven. It is capable of producing products in laser-sintered nylon, high resolution stereolithography, polyjet and multijet printing, professional fused deposition modeling and full-color binder jetting, which are the main technologies currently adopted at a B2C level.

Just Materialise It

Founded in Leuven, Belgium, by Wilfred Vancraen, Materialise is one of Europe’s largest industrial level 3D printing service. In 2012 it launched the i.Materialise division, which it uses to offer B2C 3D printing services. After being listed on the US NASDAQ index in mid-2014, Materialise became the only public company involved with B2C 3D printing, so it is one of the companies we know the most about.

Materialise’s recorded revenues of €81 million in fiscal year 2014, growing by 18.4%. It also recorded profits for €1.8 million, which were about half as the year before but still significant. Materialise however bases its business mostly on 3D software development and distribution, which accounted for 22% of all sales, with medical 3D printing services accounting for 37%. The industrial segment – which included i.Materialise – accounted for 40% of revenues and, while i.Materialise is just a tiny part of it at this moment; it is also the segment where the company is investing the most in. The results will have to be seen further down the line as investors have so far been skeptical about Materialise’s possibilities, with the stock losing over 40% since the IPO and going from $12 to below $7. If you believe in the future of 3D printing, this might be your best chance to buy into it.

Remote factory and distributed production

There are a few more B2C business models that we should consider, although they are not yet public, so their investors are currently limited to large venture capitalists. One is Sculpteo, a Paris, France, based company (with US offices in San Francisco), co-founded by current CEO Clement Moreau in 2009. While it does offer several different on-demand 3D printing services to individuals, Sculpteo’s stands out in particular for its Batch Control offer, which allows users to remotely use its laser sintering machines for short series production. In other words, it puts a central factory remotely in the hands of anyone.

Rinkak, the largest B2C 3D printing service in Asia has been following an almost opposite approach. The company, founded by six partners, now “hires” remote 3D printers to help it carry out the orders received centrally. If you own a 3D printer, you can simply sign up and become a “remote factory”, partnering with the Rinkak network. In mid-2014 Rinkak secured $2 million in financing from the Cyber Agent Ventures fund, which it used to expand its operations overseas, especially in the US.

The extreme materialization of the distributed manufacturing trend is 3D Hubs, a Dutch startup with offices in Amsterdam and Holland, which has created a network of 13.000 (and counting) 3D printers throughout the world. While most of these are desktop fused filament based 3D printers, several professional 3D grade 3D printers have recently been added, thus making 3D Hubs a fully delocalized B2C 3D printing service. The company’s exponential growth and business model has convinced investors as the startup founded by Bram de Zwart and Brian Garret raised $4.5 in a Series A led by Mark Evans, General Partner at Balderton Capital.

From industry to consumer?

There finally are two more 3D printing services that may represent an interesting investment possibility as they are already publicly traded. The first is Protolabs, a huge multinational company that offers both 3D printing and more traditional manufacturing services (such as CNC milling and injection molding) at a high industrial level. Because of its ability to diversify, Protolabs’ stock is fairly stable, currently trading on the NYSE at about $70, after peaking at $85 in mid-2014. During the last full financial year (2013) The company reached record revenues of $115 million, growing by more than 20% and with net revenues set at more than $35. The company’s early investment in 3D printing makes it a sure bet for the future as well.

Another option is Germany based Alphaform, which is traded on three different German indexes. Although its stock has lost close to 5%, trading at €2.89 form the peak of €4.5 reached in early 2014. This means it is valued significantly less than its yearly revenues, which were €29 million in fiscal year 2014, after growing by 11.6%. The reason it trades so low is that in 2013 the company recorded a net loss of more than €6 million, which was reduced to €3 million in 2014. This clashes with the hype around the industry but Alphaform is a good bet, having just singed a €10 million contract, the largest in the company’s history, and launched a 3D printed art service for consumers called Artshapes.

B2C is the future of service and the first step in the future of manufacturing. Whether that future has already begun is your call.

We continue this series – please feel free to give some feedback. If you want to stay informed, please consider adding our newsfeed.

License: The text of "How to invest in 3D printing stock (Part 2)" by All3DP is licensed under a Creative Commons Attribution 4.0 International License.