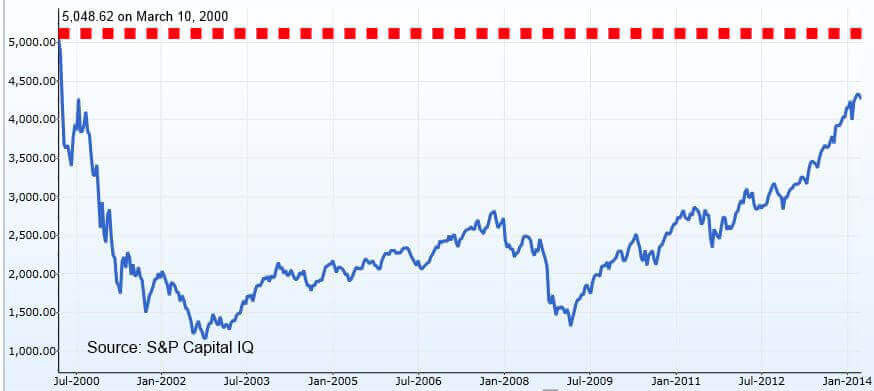

At one point, at the end of 2013, stocks in 3D printing companies were the hottest item on the global exchanges. Everyone wanted in on them, driving prices sky high. Since then they have lost most of their “added” value, dropping between 20% and 80% from their peak point. For the larger companies, 3D Systems and Stratasys, the peak was the high point of a run that had begun more than a decade ago, for newcomers such as Voxeljet, ExOne and Organovo, it was a way to obtain funds to invest in further development of their technology. For most of us small investors, who got on board too late, it was a brief illusion of quick returns but we did it knowing well that 3D printing stocks are a long term investment.

My personal opinion about the stock market is that small investors never win, just like in any casino. I had never bought stocks before, although I am fascinated by the “financial monster’s” ups and downs. Small investors always find out about the right stock too late, they always buy right after the peak, only to lose hope and sell before a new upward trend begins. Experience has shown, however, that it is possible to win in the long run. Even if you bought major stocks right before the great financial collapse of 1929 that would still be the best investment you could have possibly made since then.

Don’t get too hyped up

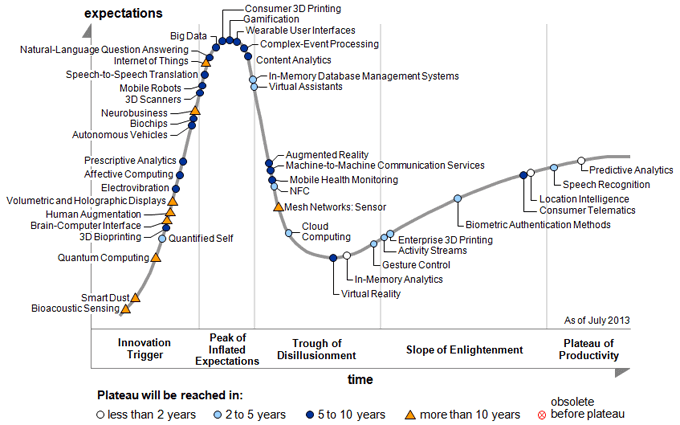

The key factor to remember is that 3D printing is the future. That means it is not the present. So if you decide to invest in any aspect of 3D printing you have to remember that you are investing for long term returns. That means 5, 10, 20 or even more years from now. The other factor to keep in mind is Gartner’s “hype curve”. The diagram describes the growth of any new technology as a first peak relating to consumer enthusiasm, followed by a steep fall and then a more stable, organic growth.

In this diagram, professional 3D printing has already started up the second growth phase, while consumer 3D printing has just surpassed the initial peak of enthusiasm. These two aspects are intertwined when it comes to stock fluctuations: a peak in consumer enthusiasm can push the value of professional 3D printing companies higher. In fact, while additive manufacturing technologies were invented in the late 1980s, in the beginning they were confined to extremely high-level companies and projects: a phase which we could define as “the rise of high-end industrial 3D printing”

Industry driving consumers

The next phase, driven by the “professional 3D printing” peak of enthusiasm, took place around 2007. More companies could get access to 3D printers than ever before, at entry-level prices that had dropped from above $100.000 to around $30.000. This also contributed to spawning the very first consumer 3D printers (such as the first MakerBots). In return, the consumer enthusiasm peak of 2013 drove 3D printing stocks to record highs.

The 2013 peak was the third and most significant peak up to this point. It will likely be the last sharp rise and fall, as all future growth will be related to gradually driving mass-market adoption of 3D printing technologies. Since the end of 2013, all publicly traded 3D printing companies have dropped in value by 40% or more. In many cases they are still assigned a value that is significantly higher than the company’s actual turnover, so they might may go even lower. However, their long term potential has remained virtually unvaried, so the current “down period” might be the best chance to buy you are going to get.

Sustainability

All the larger 3D printing companies, both the ones that are publicly traded and the ones that are not, are registering yearly growth in revenues by around 30 to 35%. Any more than this is unsustainable for companies that already have several hundred employees and many offices worldwide. Their business models are solid and their technologies are both advanced and difficult to imitate or replicate. Nevertheless, the professional investors no longer see the booming (and unsustainable) growth and the mini-bubble that formed around 3D printing stocks has now burst. Winning back the losses might take several months and even years.

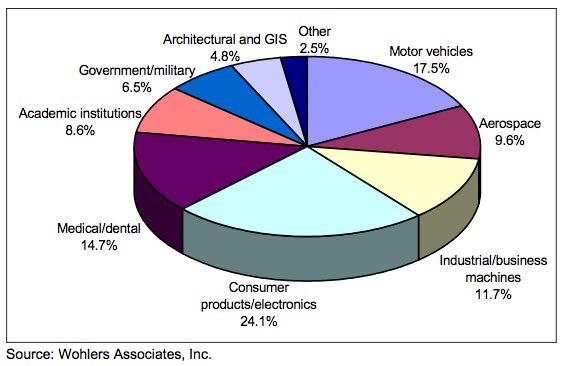

What happened is the same thing that happens to any single person when he or she first discovers 3D printing and its potential to change the world. This initial awe is followed by realization that yes, 3D printing will change the world, but it will take many, many years for such a disruptive technology to really take hold. Wohlers Associates, another market research firm that has been focusing on 3D printing, estimates that, in the best-case scenario, the AM industry may be worth 2% of the $20 trillion global manufacturing industry by 2030 (read the All3DP interview here). That means it will generate revenues of about $200 billion. Since the global AM industry today is worth about $4 billion, this means a 5000% growth over the next 15 years.

Investment opportunities

This is more than enough to attract investors but all must remember that it will mostly be the large companies that will benefit from this growth. Another aspect to remember is that, even if this scenario actually took place, additive manufacturing (AM) would still only represent 2% of all manufacturing 15 years from now, which would mean 98% of all manufacturing will still be carried out by traditional means. Thus the world will not look that much different from what it does now. Real change is slow. For example, even though we have been witnessing record adoption of renewable energy, most of the world’s energy production still takes place inside highly polluting coal plants.

Those who are enthusiastic about 3D printing dream of a world where manufacturing is distributed and open source. Open source, that is the sharing of technological research and advancements, is the industrial equivalent of renewable energy. It is healthier, more democratic, more sustainable and fair. The adoption of open source business models is at the same time a great opportunity and a threat for many traditional companies, including event the large 3D printers manufacturers.

A win-win situation

However the economic advantages of open source could be enormous and, like other technological revolutions, will make their way into society whether today’s leading companies adopt this new approach or not. Professor Joshua Pearce from Michigan Tech University, an expert in both renewable/sustainable energy and open source 3D printing, quantified the value of a a single, shared, open source design for a mechanical pump used in medical research at several hundred million dollars. That’s because the single design can be affordably produced by thousands of researchers throughout the world, improved upon, and shared again. These savings can be directly passed on to the university, which can use them to buy more advanced expensive machinery, hire more researchers, and speed up research in a win-win situation.

Start-ups such as 3D Hubs and a few others envision such a distributed business model for all manufacturing. They seek to apply the concept of successful P2P (person to person) approaches such as those currently implemented by Airbnb, BlaBlaCar or Uber to industrial production. While that is something that will take several years to take form, the number of 3D Hubs users is growing exponentially and so are the products and the quality of the products offered. Unless you have millions, investing in 3D Hubs today means buying a 3D printer and joining the network. There are many more start-ups that are actively working to revolutionize manufacturing through 3D printing.

We all win or we all lose

Many of them are part of Autodesk’s Spark Fund. Many others are housed inside Brooklyn’s New Lab incubator. A few more are stemming of Israel (an Eldorado for start-ups) and most of them hope to be bought out by Stratasys and 3D Systems, the two 3D printing leaders who have been hoarding on start-ups over the past few years. That strategy has paid off only partially, though.

The risk is that the current tech bubble, which has pushed the NASDAQ index to record levels again, just like it did before the 2001 global crisis, might burst and temporarily drag down even those companies – such as 3D printer manufacturers – which are only partially inflated and are actually based on very solid business models, real growth and a lot of R&D. If that were to happen, the damage might be even larger than the that of the previous global crisis and might lead to an all out global war in worst case. It is not very nice to think about it but this scenario is possible. In such a scenario, with a technological arms race under way, 3D printing companies would likely thrive. On the other hand, the best way to avoid this prospect is to begin making manufacturing more sustainable and fair. And 3D printing companies will still likely thrive. Either way you look at it, additive manufacturing is the future.

If you want to read on, here’s Part 2 of “How to invest in 3D printing stock”.

License: The text of "Investing in 3D printing: part one" by All3DP is licensed under a Creative Commons Attribution 4.0 International License.